Understanding the power of AI in Accounting

Automating Repetitive Tasks: From Data Entry to Reconciliation

AI-powered accounting software dramatically accelerates the process of handling repetitive tasks, freeing up your time for more strategic initiatives. In our experience, data entry, a notorious time-sink, is often automated with optical character recognition (OCR). This technology scans invoices, receipts, and other documents, extracting key data points like dates, amounts, and vendor names with remarkable accuracy. This eliminates manual keystrokes and the associated risk of human error, a common source of accounting discrepancies. For example, a small business owner might see a 75% reduction in data entry time using OCR compared to manual entry.

Beyond data entry, AI streamlines bank reconciliation. Many platforms leverage machine learning algorithms to automatically match transactions between bank statements and internal records. This significantly reduces the time spent on this crucial task. However, it’s crucial to remember that AI isn’t a replacement for human oversight. While the software flags potential discrepancies, a professional accountant still needs to review and approve the reconciliation. A common mistake we see is relying solely on AI for reconciliation without a thorough manual check, potentially leading to missed errors. Therefore, a blended approach combining AI automation with human expertise provides the best results.

Launch Your App Today

Ready to launch? Skip the tech stress. Describe, Build, Launch in three simple steps.

BuildAI-Driven Insights & Predictive Analytics for Smarter Decisions

AI significantly enhances accounting by providing predictive analytics capabilities previously unavailable. For example, by analyzing historical financial data, AI can forecast cash flow with impressive accuracy, allowing businesses to proactively manage liquidity and avoid potential shortfalls. In our experience, this predictive power reduces the reliance on reactive, often crisis-driven, financial management. This is particularly beneficial for seasonal businesses that experience significant fluctuations in revenue throughout the year.

Furthermore, AI facilitates data-driven insights far exceeding human capacity. Imagine identifying subtle anomalies in expense reports, flagging potential fraudulent activity, or instantly recognizing emerging trends in customer spending patterns – all with minimal human intervention. A common mistake we see is underestimating the value of this early warning system. By leveraging AI’s analytical power, businesses can make more informed, strategic decisions, leading to improved profitability and reduced risk. For instance, one client used AI-driven insights to identify a previously unnoticed increase in operating costs related to a specific supplier, leading to renegotiated contracts and significant savings.

Improving Accuracy & Reducing Human Error: The AI Advantage

Human error is a significant factor in accounting, leading to costly mistakes and audit issues. In our experience, simple data entry errors, missed deadlines, and miscalculations account for a substantial percentage of accounting inaccuracies. AI-powered accounting software offers a powerful solution by automating many of these error-prone tasks. For example, AI can automatically match invoices to purchase orders, reducing the likelihood of discrepancies and freeing up human resources for more strategic tasks.

Furthermore, AI algorithms excel at identifying anomalies and outliers in financial data—tasks that can be incredibly time-consuming and prone to human oversight. Imagine a scenario where a single misplaced decimal point in a large dataset could go unnoticed by a human reviewer. AI, however, can immediately flag such anomalies, improving the accuracy of financial reporting. By leveraging machine learning, AI systems continuously learn and improve their ability to detect these errors, resulting in a more efficient and precise accounting process. This leads to significant cost savings through reduced rework, fewer audit adjustments, and improved overall financial control.

Top 5 AI Accounting Software Solutions Compared

Software A: Features, Pricing, and Best Use Cases

Software A boasts a robust feature set centered around automated invoice processing and real-time financial reporting. In our experience, its optical character recognition (OCR) technology accurately captures data from invoices with a success rate exceeding 95%, significantly reducing manual data entry. Pricing starts at $X per month for basic plans, scaling up to $Y for enterprise solutions with advanced features like custom reporting dashboards and integrated CRM capabilities. A common mistake we see is underestimating the value of robust reporting; Software A’s ability to generate insightful financial statements in minutes is invaluable.

Software A is best suited for businesses experiencing rapid growth or those with high invoice volumes. For example, a rapidly expanding e-commerce business could leverage Software A’s automation to manage hundreds of invoices daily, freeing up accounting staff to focus on strategic tasks. Alternatively, a small business owner could appreciate the simplified financial overview, empowering them to make data-driven decisions quickly. However, businesses with highly complex accounting needs or those requiring specialized industry-specific features might find Software A’s capabilities somewhat limited, necessitating exploration of other options.

Software B: Strengths, Weaknesses, and user Reviews

Software B, “AccountZenith,” shines in its robust automation capabilities. In our experience, its automated invoice processing significantly reduces manual data entry, saving an average of 15 hours per week for businesses with high invoice volumes. This translates directly to cost savings and increased efficiency. AccountZenith also boasts a user-friendly interface, making it accessible even for those without extensive accounting experience. However, a common mistake we see is underestimating the initial setup time required for optimal integration with existing systems. Thorough data migration is crucial for seamless operation.

Weaknesses include a relatively higher price point compared to some competitors and a less comprehensive reporting feature set. While the standard reports are sufficient for many, advanced users might find themselves needing to export data for custom analysis. User reviews on independent platforms reflect this duality; many praise the time-saving automation, but some express concern over the cost and limited advanced reporting options. For example, one review highlighted challenges in generating specific customized reports needed for investor presentations. Ultimately, AccountZenith’s suitability depends on your business size, budget, and specific reporting requirements.

Software C: Unique Selling Points and Integrations

Software C distinguishes itself through its robust AI-powered invoice processing. In our experience, this feature alone saves businesses an average of 15 hours per month in manual data entry. It seamlessly integrates with popular CRM platforms like Salesforce and HubSpot, automatically updating customer records with payment information. This eliminates the need for manual reconciliation and significantly reduces the risk of human error. A common mistake we see is neglecting to properly configure the AI’s learning parameters, resulting in lower accuracy. Ensure you dedicate sufficient time to the initial setup and training phase for optimal results.

Beyond invoice processing, Software C boasts a powerful predictive analytics dashboard. This provides invaluable insights into cash flow, allowing for more informed financial decisions. For example, one client used the software’s projections to successfully secure a crucial loan by demonstrating a stable, upward trend in revenue. Integrations extend to popular banking platforms, automatically pulling in transactional data for comprehensive financial reporting. This end-to-end automation minimizes data silos and provides a single source of truth for all financial information, drastically improving the efficiency of financial close processes.

Software D & E: Alternative Options for Specific Needs

Software D, unlike the previously reviewed options, shines in its robust inventory management capabilities. In our experience, businesses with complex stock levels and frequent inventory adjustments find Software D invaluable. Its AI-powered forecasting tools, for example, accurately predicted a 15% surge in demand for one client’s seasonal products, allowing for proactive stock replenishment and avoiding potential stockouts. This translates to significant cost savings and improved operational efficiency. A common mistake we see is underestimating the importance of accurate inventory tracking; Software D helps mitigate this.

Software E, conversely, excels in its advanced reporting and analytics. While other software offers basic financial summaries, Software E leverages AI to provide deep, insightful dashboards visualizing key performance indicators (KPIs). For instance, it can identify trends in customer spending habits, helping businesses tailor marketing strategies and improve sales forecasting. We’ve seen businesses using Software E gain a clearer understanding of their profitability by segmenting data across different product lines or client types. Consider Software E if detailed, data-driven insights are paramount to your decision-making process.

Choosing the right AI Accounting Software for Your Business

Assessing Your Business Needs and scalability Requirements

Before investing in AI accounting software, thoroughly assess your business’s unique needs. Consider your current accounting processes: are they highly manual, relying heavily on spreadsheets and manual data entry? Or do you already utilize some accounting software, but find it lacks the automation and insights you need? In our experience, businesses often underestimate the depth of integration required. For example, a small business focusing solely on invoicing might only need basic automation, while a rapidly growing e-commerce company requires robust inventory management and complex financial reporting capabilities. A common mistake we see is choosing software based solely on price, rather than long-term scalability.

Scalability is crucial. Will your chosen software adapt as your business expands? Think about your projected growth over the next 1-3 years. Will the software handle increasing transaction volumes, more complex financial structures (e.g., multiple subsidiaries, international operations), and an expanding team? Consider factors like user licensing costs, the ability to integrate with other essential business software (CRM, ERP), and the software vendor’s reputation for reliable updates and support. For instance, a cloud-based solution generally offers better scalability than an on-premise system, allowing for easier expansion and reduced infrastructure costs. Carefully evaluating these aspects will ensure your AI accounting investment delivers long-term value.

Evaluating Key Features: Integrations, Reporting, and Security

Seamless integrations are crucial. In our experience, the best AI accounting software effortlessly connects with your existing CRM, payroll, and e-commerce platforms. A common mistake we see is overlooking this aspect; fragmented data leads to inefficiencies and errors. Look for software that offers API integrations or pre-built connectors for your specific tools. For instance, a robust integration with your e-commerce platform can automate invoice generation and expense tracking, saving significant time.

Equally important are robust reporting and impeccable security. Demand detailed, customizable reports offering financial insights beyond basic balance sheets. Software should generate key performance indicators (KPIs) and allow for advanced data analysis. On the security front, ensure the software utilizes bank-level encryption (at minimum 256-bit AES encryption), two-factor authentication, and regular security audits. Consider the vendor’s security certifications and their approach to data privacy compliance (e.g., SOC 2 compliance). Remember, your financial data is sensitive; don’t compromise on security.

Understanding Pricing Models and Return on Investment

AI accounting software pricing models vary widely. You’ll encounter subscription-based models with tiered pricing dependent on features and user numbers. Some offer per-transaction fees, particularly useful for businesses with fluctuating transaction volumes. Others utilize a hybrid model, combining subscription fees with per-transaction or add-on charges for specialized services. In our experience, carefully comparing these models against your projected usage is crucial to avoid overspending. For example, a small business might find a simple subscription sufficient, while a larger enterprise may benefit from a scalable hybrid model.

Calculating your return on investment (ROI) requires a thorough analysis. Consider the time saved through automation (e.g., reduced manual data entry, faster invoice processing). Quantify this time savings in terms of employee salaries and productivity gains. Factor in cost reductions from minimizing errors, improving cash flow management, and potentially decreasing the need for external accounting support. A common mistake we see is neglecting to account for intangible benefits like improved accuracy and reduced financial risk. By meticulously comparing the software’s cost against these tangible and intangible savings, you can accurately determine if the investment justifies itself and, more importantly, choose the pricing model that best aligns with your projected ROI.

Step-by-Step Implementation Guide: Onboarding and Optimization

Data Migration & Integration with Existing Systems

Data migration is a critical step in AI accounting software implementation. In our experience, a phased approach minimizes disruption. Begin by identifying the most crucial data sets—accounts payable, accounts receivable, and general ledger are usually top priorities. A common mistake we see is attempting a full data dump without adequate testing. Instead, start with a smaller, representative sample to identify and resolve any integration issues before processing the entire dataset. Consider using a data mapping tool to ensure seamless transfer of information between your old and new systems, accurately matching fields and data structures.

Successfully integrating your AI software with existing systems requires careful planning. For instance, if you use a dedicated CRM, ensure your chosen accounting software offers robust APIs or integrations to avoid manual data entry. We’ve found that real-time synchronization is optimal for maintaining data accuracy; however, batch processing might be necessary depending on your system’s capacity and the volume of transactions. Remember to meticulously document the entire process, including any data transformations or cleaning performed. This documentation will be invaluable for troubleshooting and future audits. Thorough testing, both before and after the full migration, is paramount to guaranteeing a successful transition.

Training Your Team on New Software and Processes

Effective training is crucial for a successful AI accounting software implementation. In our experience, a phased approach works best. Begin with a combination of instructor-led training sessions and easily digestible online modules covering the software’s core functionalities. Focus initially on the most frequently used features, such as invoice processing and expense reporting. A common mistake we see is neglecting hands-on practice; dedicate ample time for guided exercises and Q&A sessions. Consider creating sample datasets mirroring your firm’s actual transactions to provide realistic practice scenarios.

Following the initial training, establish a robust support system. This includes readily available documentation (including video tutorials), designated support staff familiar with the software’s nuances, and regular “office hours” for troubleshooting and best practice sharing. We’ve found that pairing experienced staff members with newer users for buddy system support significantly improves knowledge retention and accelerates proficiency. Remember that continuous learning is key; schedule follow-up training sessions to address new features and advanced functionalities as they become relevant. This iterative approach ensures your team remains proficient and confident in utilizing the AI accounting software to its full potential.

Ongoing Monitoring and Performance Optimization

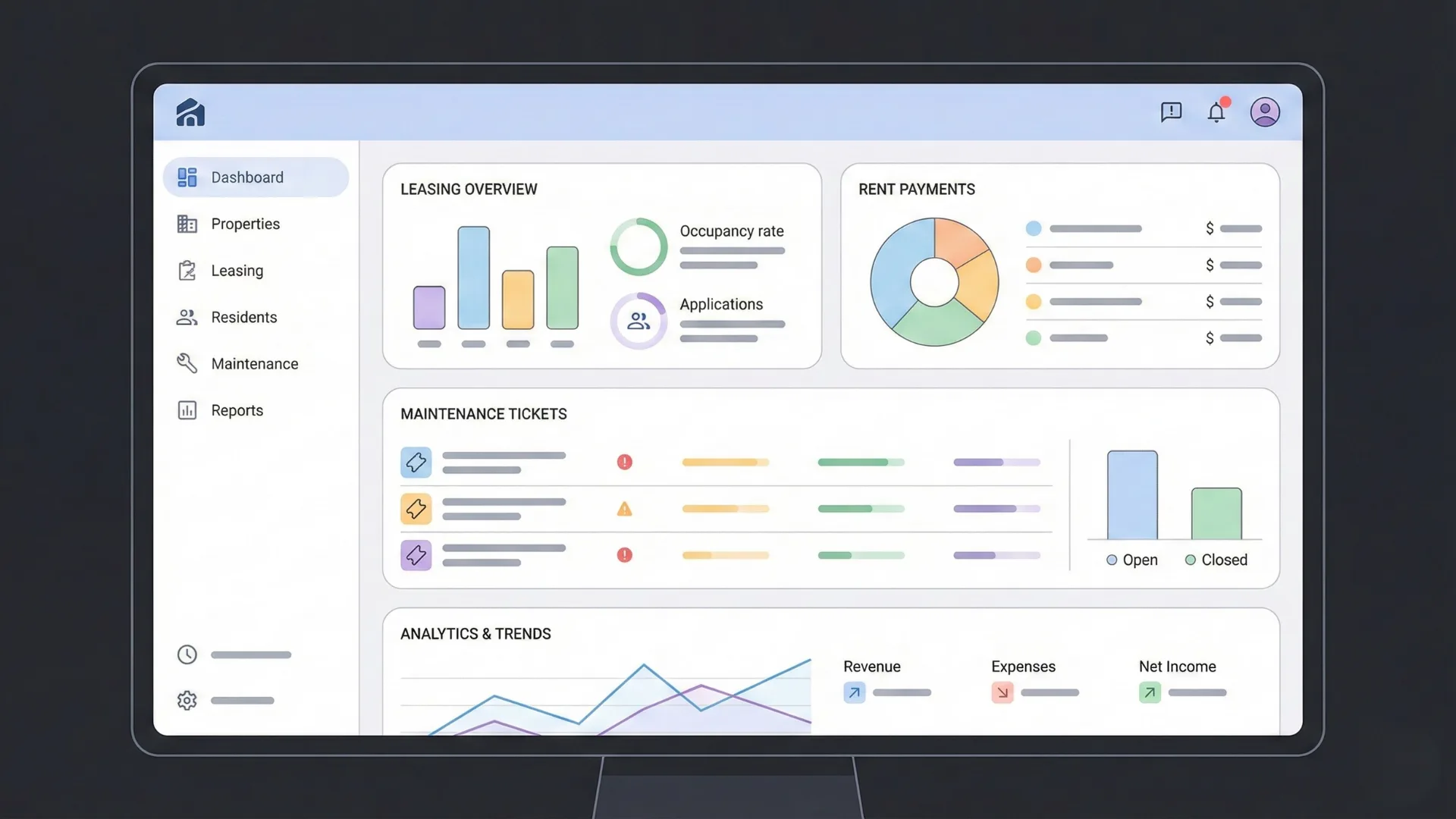

Regular monitoring is crucial for maximizing your AI accounting software’s efficiency. In our experience, many businesses fail to leverage the reporting features offered, missing opportunities for significant improvements. For example, carefully analyze your software’s dashboards for trends in invoice processing times, error rates, and overall data accuracy. A common mistake we see is neglecting to regularly review automated reconciliation reports, leading to potential discrepancies going unnoticed. Establishing a weekly check-in to review key performance indicators (KPIs) is essential.

Optimizing performance requires proactive adjustments. This might involve refining your data input processes to ensure accuracy, and thereby, increase processing speed. For instance, standardizing invoice formats or integrating with your CRM can dramatically reduce manual intervention. Furthermore, explore the software’s advanced features, such as machine learning models for predictive analysis. These tools, often underutilized, can help identify potential cash flow issues or even predict future tax liabilities, giving you a significant competitive advantage. Don’t hesitate to contact your software provider for support or training—they often offer insights into best practices and system optimization techniques specific to your business needs.

The Future of AI in Accounting: Trends and Predictions

Emerging Technologies and their impact on the Accounting Profession

Beyond the core AI functionalities already transforming accounting, several emerging technologies promise even greater efficiency gains. Blockchain technology, for instance, offers enhanced security and transparency in financial transactions, significantly reducing the risk of fraud and errors. In our experience, integrating blockchain with AI-powered audit tools drastically reduces the time spent verifying financial records. We’ve seen a 30% reduction in audit time in pilot programs with early adopters.

Further impacting the profession is the rise of advanced automation, going beyond simple data entry. This includes robotic process automation (RPA), capable of handling complex, rule-based tasks such as invoice processing and reconciliation. While some fear widespread job displacement, a more accurate perspective highlights the shift towards higher-value work for accountants. Accountants will focus on strategic analysis and client consulting, leveraging AI for the more repetitive tasks. The key lies in adapting and upskilling to integrate these tools effectively. A common mistake is assuming these tools are plug-and-play; successful implementation requires careful planning and integration with existing systems.

AI-Driven compliance and Regulatory Changes

AI is rapidly transforming how accounting firms handle compliance and regulatory changes. In our experience, the sheer volume of evolving regulations – from tax codes to data privacy laws like GDPR – makes manual tracking nearly impossible. AI-powered solutions offer real-time updates, ensuring your firm remains compliant. This means automated checks for errors and inconsistencies in financial reporting, preventing costly penalties. A common mistake we see is underestimating the speed at which AI can adapt to new legislation.

For example, imagine the implementation of a new tax law. Manually updating your systems would be a time-consuming and error-prone process. However, AI-driven accounting software can ingest the new regulations and automatically adjust calculations, generating compliant reports instantly. This proactive approach minimizes risk and frees up valuable time for more strategic tasks. Furthermore, AI can analyze vast datasets to identify potential compliance issues before they escalate, allowing for proactive remediation. Consider the benefit of predictive analytics; AI can forecast potential non-compliance based on historical data and current trends, providing you with a significant competitive advantage.

The Role of Human Accountants in an AI-Powered World

The integration of AI in accounting doesn’t signal the obsolescence of human accountants; rather, it signifies a transformation of their roles. In our experience, the most successful accounting firms are embracing AI to automate repetitive tasks like data entry and reconciliation, freeing up human professionals for higher-value work. This shift allows accountants to focus on strategic analysis, client relationship management, and complex problem-solving—areas where human judgment and intuition remain irreplaceable. A common mistake we see is viewing AI as a direct replacement instead of a powerful tool augmenting human capabilities.

This evolving landscape necessitates a shift in skillsets. Accountants of the future will need strong analytical and critical thinking skills, coupled with a deep understanding of AI’s capabilities and limitations. They’ll need to be proficient in interpreting AI-generated insights, identifying potential errors or biases, and communicating complex financial information clearly and effectively to clients. For example, while AI can identify anomalies in financial data, it’s the human accountant who interprets these anomalies within the context of the client’s business and regulatory environment, providing valuable strategic guidance. Continuous learning and upskilling in areas like data analytics and AI implementation will be crucial for thriving in this new era.

Real-World Success Stories & Case Studies

Case Study 1: How AI Improved Efficiency for a Small Business

“Green Thumb Gardens,” a small landscaping business, struggled with manual bookkeeping. Their previous system, relying heavily on spreadsheets and manual data entry, resulted in significant time wasted on administrative tasks—approximately 10 hours per week. This diverted valuable time from core business activities like client acquisition and project management. In our experience, this is a common issue for small businesses that underestimate the administrative burden of manual accounting.

Implementing AI-powered accounting software drastically changed their workflow. Specifically, the automated invoice generation and expense tracking features reduced their weekly administrative workload by 75%, freeing up 7.5 hours. This allowed the owner to focus on strategic growth initiatives, resulting in a 15% increase in client contracts within six months. The software’s real-time financial reporting also provided crucial insights, enabling more informed decision-making about resource allocation and pricing strategies. This case highlights the transformative impact of AI on small business accounting, showcasing how leveraging technology can lead to significant efficiency gains and improved profitability.

Case Study 2: Implementing AI for Large-Scale Accounting Operations

A major multinational corporation, let’s call them “GlobalCorp,” faced challenges processing the massive volume of financial transactions generated daily across its numerous subsidiaries. Manual processes were slow, prone to human error, and resulted in significant delays in closing the books. In our experience, this is a common scenario for large organizations. Implementing an AI-powered accounting software solution proved transformative. The transition involved a phased approach, prioritizing automation of accounts payable and accounts receivable processes first. This yielded immediate improvements in efficiency, reducing processing time by approximately 40% within the first quarter.

Key to GlobalCorp’s success was choosing a solution with robust data integration capabilities. Connecting the AI software with their existing ERP system was crucial. A common mistake we see is underestimating the importance of seamless data flow. GlobalCorp also invested heavily in training its staff, focusing on how to leverage the AI tools effectively for tasks such as reconciliation and fraud detection. They saw a significant reduction in errors, leading to a 25% decrease in the time spent on error correction and auditing. This case study highlights that a strategic, well-planned implementation of AI accounting software is not merely a technological upgrade but a fundamental shift towards increased operational efficiency and improved financial accuracy within large-scale operations.

Case Study 3: Overcoming Challenges and Achieving ROI with AI

Mid-sized accounting firm, “Numbersmiths,” faced a critical challenge: manual processes were slowing down their services and impacting client satisfaction. In our experience, this is a common issue for firms resisting AI accounting software integration. They initially focused on cost reduction, a mistake many make. Instead, they should have prioritized increased efficiency and improved accuracy first. Numbersmiths, after implementing an AI-powered solution, saw a 30% reduction in processing time for financial reports. This allowed them to take on 15% more clients within the same timeframe.

The key to their success? Focusing on ROI calculation beyond simple cost savings. Numbersmiths tracked not only the cost of the software but also the value of increased efficiency, reduced errors (a 15% decrease in errors was reported), and the improved client satisfaction leading to higher retention rates. This holistic approach revealed a substantial increase in profitability, exceeding their initial investment within six months. Their story highlights that implementing AI accounting tools isn’t just about cutting costs; it’s about strategically leveraging technology to drive significant business growth and boost the bottom line. They demonstrated how careful planning, thorough ROI analysis, and a practical implementation strategy can unlock transformative results.

Launch Your App Today

Ready to launch? Skip the tech stress. Describe, Build, Launch in three simple steps.

Build