Payment gateway integration in no-code apps allows businesses to accept payments seamlessly without writing a single line of code. This process uses visual tools and pre-built components that simplify embedding payment systems into apps built on platforms like Bubble, FlutterFlow, or Stripe. No-code payment integration empowers users to enhance their app’s functionality quickly and efficiently while maintaining flexibility and security.

With an increasing number of no-code platforms supporting payment gateways, businesses can focus on improving the customer experience by offering smooth and hassle-free transactions. Integration steps often involve simple actions like mapping payment fields or installing extensions, making the process accessible even to non-developers.

Launch Your App Today

Ready to launch? Skip the tech stress. Describe, Build, Launch in three simple steps.

BuildThis approach helps companies maintain their existing software environments while upgrading payment capabilities, eliminating the need for costly developer resources. By leveraging no-code solutions, teams can scale their payment systems with ease and adapt to changing business needs.

Understanding Payment Gateway Integration

Integrating a payment gateway into a no-code app involves secure transaction handling, real-time processing, and valuable insights through analytics. It also supports compliance with security regulations and fits well within agile development, such as building a minimum viable product (MVP).

What Is a Payment Gateway?

A payment gateway is a technology that captures and encrypts payment details during online purchases. It acts as the interface between the customer and the payment processor, ensuring sensitive data is securely transmitted.

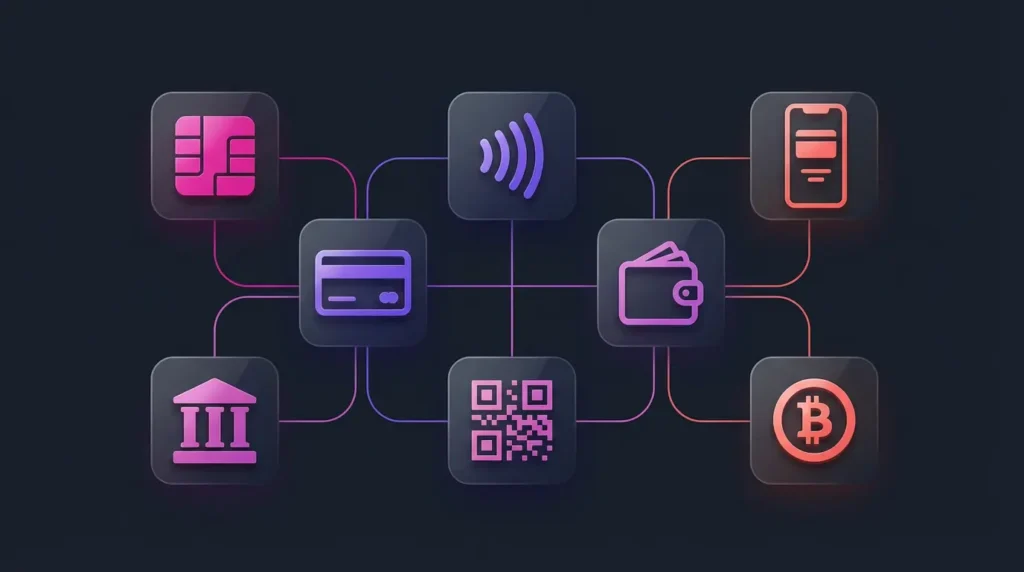

Payment gateways are essential for processing credit cards, digital wallets, and other electronic payments. In no-code apps, these gateways can be integrated without coding, using pre-built tools and visual interfaces.

This technology handles encryption, authentication, and fraud prevention by meeting security standards like GDPR and SOC2, protecting both businesses and customers. It also gives businesses the ability to monitor transactions via analytics dashboards.

How Payment Gateways Work

Payment gateways facilitate the payment authorization process in several steps:

- The customer enters payment details in the app.

- The gateway encrypts this data and sends it to the payment processor.

- The processor communicates with the issuing bank for approval.

- Once approved, the gateway confirms the transaction to the app.

This process occurs within seconds, providing a seamless customer experience.

For no-code platforms, integration involves connecting APIs or using plug-ins that handle each step automatically. They also maintain secure data transmission to comply with privacy and security protocols.

Key Advantages of Integrating Payment Gateways

Integrating a payment gateway allows no-code apps to accept payments quickly and securely without extensive development effort.

Key benefits include:

- Speed to Market: Enables launching an MVP with payment capabilities rapidly.

- Security: Ensures compliance with GDPR, SOC2, and other regulations through built-in security checks.

- Data Insight: Provides detailed transaction reports and analytics dashboards for business monitoring.

- Customer Trust: Improves conversion rates by offering familiar, reliable payment options.

These advantages support scalability and adaptability, crucial for evolving business needs in no-code environments.

The Rise of No-Code Apps

No-code apps have transformed software development by enabling non-technical users to build functional applications quickly. This shift empowers founders, solo makers, and small agencies to create professional-grade products without relying on developers or complex coding processes.

No-Code Platforms Explained

No-code platforms allow users to develop apps through visual interfaces and drag-and-drop components instead of writing code. Tools like imagine.bo and zero-code needed platforms offer pre-built templates and integrations to simplify the process further.

These platforms focus on accessibility, enabling people with little or no programming skills to design, customize, and deploy applications efficiently. Features often include automation, database management, and third-party service integration, providing professional-grade quality with less technical overhead.

Benefits for Founders and Agencies

For founders and small agencies, no-code development reduces time to market significantly. It lowers upfront costs by removing the need to hire specialized developers or contract expensive programming work.

No-code apps support rapid iterations and improvements, which is valuable for testing new ideas or responding to client feedback. The ability to maintain and update apps without specialized knowledge also empowers solo makers and teams to be agile and self-sufficient.

Common Use Cases for No-Code Apps

No-code apps are widely used for customer-facing websites, internal tools, and payment gateway integration. Businesses often leverage these platforms to set up fast and secure payment solutions without complex coding.

Other applications include CRM systems, marketing automation, and workflow management, which small agencies and startup teams can customize to fit their specific needs. These use cases highlight the versatility and efficiency no-code apps bring to various business functions.

Why Payment Gateways Matter in No-Code Solutions

Payment gateways are essential components that enable no-code apps to process transactions efficiently while maintaining security and compliance. They facilitate monetization methods, enhance user experience, and provide necessary safeguards for handling sensitive data.

Enabling Monetization and Subscriptions

Payment gateways allow no-code apps to accept payments from customers instantly, supporting multiple payment methods such as credit cards, digital wallets, and bank transfers. This flexibility is crucial for businesses looking to implement subscription models, one-time purchases, or tiered payment plans without custom coding.

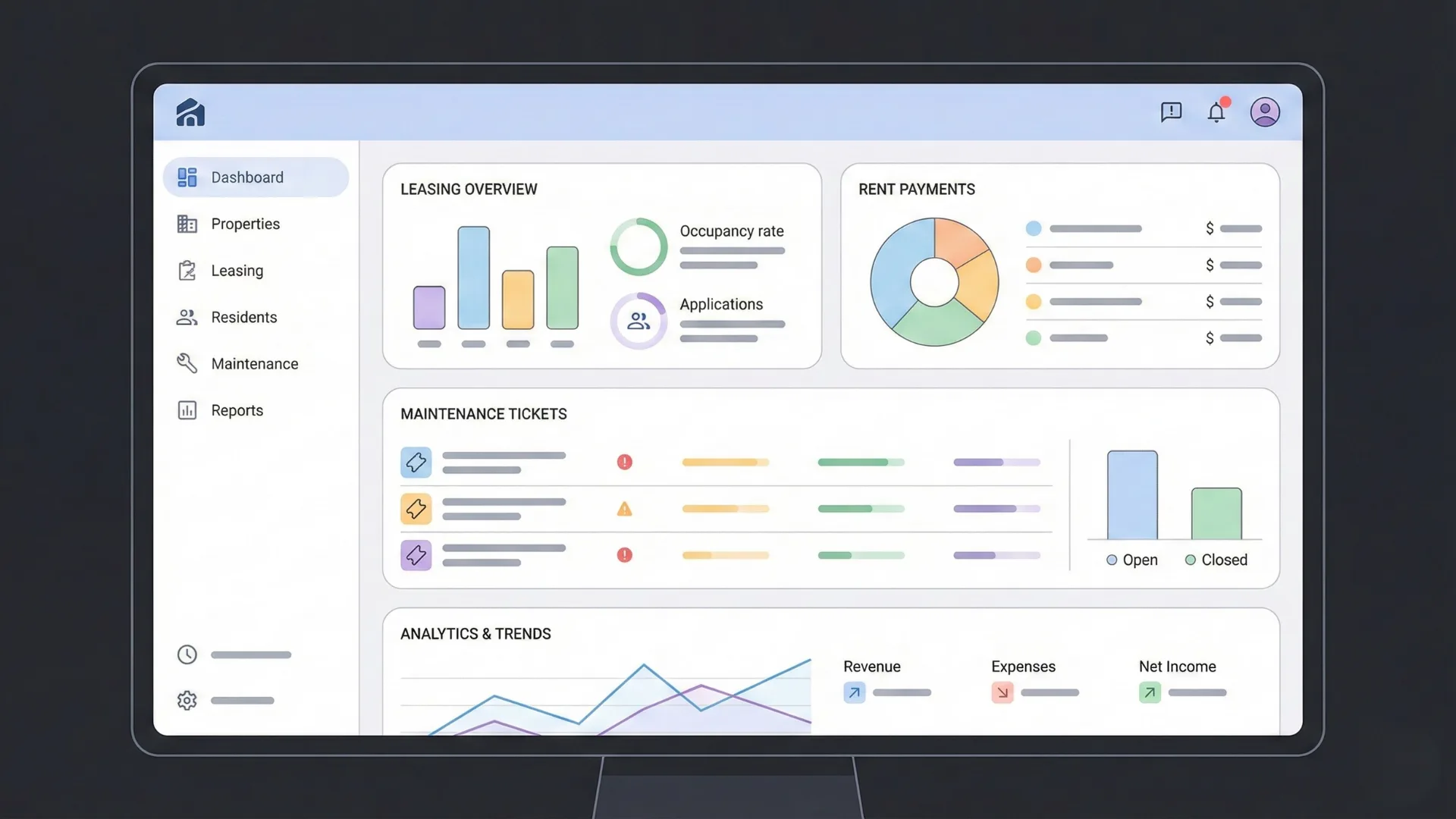

No-code platforms integrate gateways via simple API keys or drag-and-drop elements, which speeds up deployment and reduces costs. Additionally, they offer scalable infrastructure that can grow with the business, ensuring smooth transaction handling even during peak demand. Access to analytics dashboards helps businesses monitor revenue streams and subscription metrics in real time, aiding optimal decision-making.

Improving User Experience

The ease of use and speed of payment processing significantly affect customer satisfaction. No-code payment gateways streamline checkout flows, minimizing steps and reducing friction by supporting multiple currencies and local payment methods.

User-friendly interfaces allow customization of payment forms, matching branding and providing a seamless experience within the app. Many gateways support omnichannel payments, letting users pay through web, mobile, or in-app environments. This consistency across platforms is key to retaining customers and improving conversion rates.

Ensuring Security and Compliance

No-code payment solutions must meet stringent security standards to protect sensitive payment information. Gateways typically include built-in security checks like PCI-DSS compliance, GDPR adherence, and SOC2 controls to safeguard data privacy and prevent fraud.

These platforms handle encryption, tokenization, and fraud detection automatically, relieving no-code app developers from complex security implementations. Robust compliance features not only protect businesses from legal risks but also build customer trust. Monitoring tools integrated into dashboards provide real-time alerts and transaction insights supporting proactive risk management.

Popular Payment Gateway Options

When integrating payment gateways with no-code apps, it is important to focus on platforms that offer reliability, ease of integration, and broad payment method support. These options provide secure processing, developer-friendly features, and strong user adoption worldwide.

Stripe

Stripe is widely used for its developer-centric API and robust features. It supports multiple payment methods including credit cards, ACH transfers, and digital wallets like Apple Pay and Google Pay.

Stripe offers a no-code integration via pre-built components and plugins compatible with popular no-code platforms. This simplifies embedding payment forms or subscription billing in apps without coding expertise. Its dashboard provides clear transaction tracking and analytics.

The platform charges a transparent fee structure, typically 2.9% + 30¢ per successful transaction for card payments. Stripe’s ability to handle global currencies and comply with regional regulations makes it suitable for businesses expanding internationally.

PayPal

PayPal is one of the most recognized online payment systems globally. It enables transactions through PayPal accounts, credit cards, and debit cards without requiring users to leave the app or site.

Its no-code payment tools allow easy setup with minimal configuration, commonly integrated into e-commerce and donation platforms. PayPal supports recurring payments, invoicing, and peer-to-peer transfers, which broadens its use cases.

Fee-wise, PayPal’s standard rate is comparable to Stripe, around 2.9% + a fixed fee per transaction. Sellers benefit from strong buyer protection policies and seamless multi-currency handling.

Square

Square is popular for its point-of-sale systems, but it also offers a payment gateway suitable for online and no-code environments. It supports credit card payments, digital wallets, and ACH transfers.

Square’s no-code integration works well with website builders and app platforms, featuring drag-and-drop components for payment buttons and checkout flows. Its reporting tools provide insights into sales performance and customer trends.

The fee for online transactions is generally 2.9% + 30¢ per transaction. Square’s business tools extend beyond payments by including inventory management and customer engagement features, appealing to small and medium businesses.

Step-by-Step: Integrating a Payment Gateway in No-Code Apps

Integrating payments into no-code applications requires precise platform selection, careful payment configuration, tailored transaction workflows, and thorough testing. Each phase ensures that transactions are secure, seamless, and aligned with business needs.

Selecting the Right Platform

Choosing the right no-code platform is crucial. Options like Bubble, FlutterFlow, and imagine.bo offer varying levels of payment integration support. Consider platforms with built-in connectors for popular gateways such as Stripe or PayPal.

Platforms hosted on cloud services like AWS, Google Cloud Platform (GCP), or Vercel provide scalability and security, which matter when handling payment data. Also, platforms with AI-generated blueprints or one-click build features can speed up integration by automating repetitive setup tasks.

Focus on compatibility with your preferred payment providers and the ease of API or webhook integration. Verify that the platform supports necessary compliance standards like PCI-DSS.

Configuring Payment Settings

After platform selection, configure the payment settings carefully. This includes setting up merchant accounts with payment processors (e.g., Stripe, PayPal). Accurate API credentials (keys, tokens) are essential for secure communication between the app and the payment gateway.

Define currency options, tax settings, and fee structures in advance. Opt for platforms that allow customizing payment links or buttons to fit your app’s UI.

Security features like fraud detection and encryption should be activated to protect sensitive data. Many no-code tools let users manage these settings without coding, simplifying compliance and setup.

Customizing Transaction Workflows

Transaction workflows must align with user experience requirements and business logic. Customize the steps users follow to complete payments, such as cart review, applying discounts, or choosing payment methods.

Use no-code automation tools to trigger events post-payment, like sending confirmation emails or updating inventory. Platforms like FlutterFlow and Bubble often have visual workflow editors that simplify this process.

It’s important to tailor workflows for different payment scenarios, including subscriptions or one-time purchases. Ensure workflows handle failures gracefully, providing clear messages and retry options.

Testing and Troubleshooting Integration

Thorough testing is necessary before launching payment features. Simulate multiple payment scenarios: successful transactions, declines, refunds, and cancellations.

Use sandbox environments provided by payment gateways to avoid real charges during tests. Monitor API responses and payment statuses closely.

Troubleshoot by checking API logs, error messages, and webhook deliveries. Platforms hosting on AWS, GCP, or Vercel often offer built-in monitoring tools that help identify integration issues quickly.

Testing also includes mobile responsiveness and load handling to ensure smooth transactions on different devices and traffic volumes.

Payment Gateway Integration with imagine.bo

Imagine.bo enables users to build payment-enabled apps using only a chat interface. It transforms descriptions of ideas into AI-generated blueprints that require zero code and can be built with one click. The platform emphasizes ease, security, and scalability by leveraging modern cloud infrastructure and expert support.

How imagine.bo Simplifies Integration

Imagine.bo eliminates the need for coding by allowing users to describe their payment integration requirements in natural language. The AI then generates a detailed blueprint outlining the payment flow and necessary components.

Users can customize supported methods like Credit Card, PayPal, and Netbanking simply through chat commands. The platform handles setting up the payment logic and UI behind the scenes, so no manual API coding is required.

The one-click build feature compiles and deploys the app instantly. This reduces integration time from days or weeks to minutes. Non-technical users gain full access to sophisticated payment gateways without intervention from developers.

Automated Security and Compliance

Imagine.bo incorporates security best practices automatically in each payment blueprint. It enforces PCI DSS standards and data encryption without user input.

Compliance controls such as fraud detection, secure tokenization, and transaction logging are built into the generated code. This reduces risks associated with handling sensitive payment data.

The platform continually updates its security protocols based on regulatory changes and emerging threats. Users benefit from expert support that ensures payment workflows remain compliant and secure without manual oversight.

Scaling Payments with Cloud Deployment

Imagine.bo deploys apps on scalable cloud platforms including AWS, GCP, and Vercel. This ensures payment processing can handle sudden spikes and high transaction volumes reliably.

The platform’s infrastructure adjusts dynamically to traffic, preventing downtime or delays during peak usage. It also offers global availability, reducing latency for international users.

Built-in cloud scalability means businesses can expand payment capacity without additional configuration. Expert support helps optimize infrastructure for performance and cost-efficiency as payment volumes grow.

Best Practices and Considerations

Integrating payment gateways in no-code apps requires attention to data security, careful selection of providers, and ongoing system upkeep. Each aspect impacts the reliability and user trust in the payment process, affecting both compliance and business operations.

User Data Protection

Protecting user data is critical during payment gateway integration. The system must comply with security standards like GDPR and SOC 2 to ensure personal and financial information is handled securely. Encryption of sensitive data both in transit and at rest is essential.

Implementing multi-layered security checks helps prevent fraud and unauthorized access. No-code platforms should support automatic PCI DSS compliance, safeguarding cardholder data without heavy manual intervention.

Regular audits and penetration testing verify the integrity of the payment setup. Integrating analytics dashboards can help monitor suspicious activities and improve risk management.

Choosing the Right Payment Gateway

Selecting a payment gateway depends on business needs such as supported payment methods, geographic reach, and technical compatibility with the no-code platform.

Key factors to evaluate include:

- Security features: Tokenization, fraud detection, and automatic chargeback handling

- Ease of integration: Availability of no-code or low-code API connectors

- Transaction fees and currency support

- Customer support and uptime guarantees

Professional-grade gateways provide detailed reporting and analytics, enabling management to track sales and identify trends through dashboards.

Maintenance and Updates

Regular maintenance is necessary to keep payment systems secure and functional. Software updates must address emerging security vulnerabilities, compliance changes, and feature enhancements.

Automated alerts for failed transactions or downtime help minimize revenue loss. It is important to review integration workflows periodically to ensure compatibility with updates in both the payment gateway and the no-code platform.

Documentation and training materials should be updated alongside technical changes to ensure support teams stay informed. Proactive maintenance reduces risks related to fraud and technical failures.

Getting Started with Payment Gateway Integration in No-Code Apps

Integrating payment gateways within no-code apps requires a clear plan to access the right tools, support, and growth strategies. Understanding entry points such as beta programs, available resources, and future scalability needs simplifies the integration process and sets expectations for cost and performance.

Joining a Private Beta

No-code platforms like imagine.bo often offer private beta access to new payment gateway features. Beta access is usually free until a specified date—in imagine.bo’s case, free until August 2025. Interested users typically join through a waitlist, submitting basic project details.

Joining a beta enables users to test cutting-edge functionality with expert support. Feedback during this phase is essential for refining the product. Beta users benefit from early access to integration tools, usually with clear pricing models disclosed upfront, helping avoid surprise costs later. It also provides a chance to influence product development priorities based on real-world needs.

Accessing Support and Resources

Successful integration depends on readily available support and documentation. Platforms like imagine.bo provide expert support, including direct help and community forums. This guidance assists in configuring payment flows, troubleshooting issues, and optimizing for different payment methods.

Comprehensive resources cover API documentation, sample projects, and no-code builder tutorials to shorten the learning curve. Clear pricing structures are often detailed here, allowing users to plan budgets efficiently. Access to these materials ensures smooth onboarding and reduces reliance on external developers.

Planning for Scalability

When building payment functionalities, scalability must be prioritized. No-code apps should choose payment gateways that handle increasing transaction volumes without performance loss or added complexity.

Consider whether the platform supports multi-currency payments, refunds, and reporting as usage grows. Scalability also involves ensuring that integrations remain maintainable as app features develop. Clear pricing tiers aligned with transaction volume help forecast expenses accurately during growth phases. Forward-thinking planning avoids costly migrations or rework when the business expands.

Future Trends in Payment Gateways for No-Code Platforms

Payment gateways for no-code platforms are evolving rapidly to meet the increasing demand for seamless, secure, and globally accessible payment solutions. Innovations in AI, security protocols, and payment options are driving this transformation, enabling businesses to build and deploy payment features quickly without technical complexity.

AI-Powered Integrations

AI is reshaping payment gateway integrations by automating complex workflows and enhancing user experience. No-code platforms increasingly use AI-generated blueprints that suggest optimized payment flows and instantly configure integration settings.

This capability allows users to build payment systems with one-click, reducing manual setup and errors. AI also supports real-time transaction risk analysis and fraud detection, improving security without additional developer input.

Overall, AI-powered payment gateways enable non-technical users to implement advanced features like dynamic routing and personalized payment options on their no-code apps, boosting efficiency and reducing time-to-market.

Evolving Security Standards

Security remains a critical focus, especially as digital payments increase in volume and complexity. No-code platforms are integrating advanced security frameworks compliant with PCI DSS and regional regulations like GDPR.

Tokenization and end-to-end encryption are now standard in no-code payment gateways to protect sensitive data. Multi-factor authentication is also becoming a required feature to mitigate unauthorized access.

Future security trends include AI-driven anomaly detection for proactive threat prevention. These developments ensure that businesses can confidently accept payments while adhering to evolving compliance requirements without deep technical knowledge.

Expanding Global Payment Options

As businesses scale internationally, no-code payment gateways are expanding their support for multiple currencies and diverse payment methods such as e-wallets, mobile payments, and cryptocurrencies.

Platforms streamline global payment setup by automatically configuring currency conversion, tax compliance, and payment method availability based on user location. This removes barriers for no-code builders targeting global markets.

Additionally, partnerships with regional payment providers enhance local payment acceptance, enabling seamless cross-border transactions. This trend empowers businesses to reach wider audiences while maintaining easy-to-manage integration through no-code tools.

Launch Your App Today

Ready to launch? Skip the tech stress. Describe, Build, Launch in three simple steps.

Build