In the fast-paced world of business, it’s easy to get obsessed with one thing: new customers. We celebrate every new sale, every new logo, and every new sign-up. This focus on acquisition is exciting, but it’s also expensive. It’s the “leaky bucket” problem: you’re so busy pouring new water in that you don’t notice how much is leaking out the bottom.

What if the real secret to sustainable growth isn’t just about finding more customers, but about getting more value from the ones you already have?

Launch Your App Today

Ready to launch? Skip the tech stress. Describe, Build, Launch in three simple steps.

BuildThis is where a metric called Customer Lifetime Value (CLV) comes in. It’s a simple concept that completely changes how you see your business—shifting your focus from short-term transactions to long-term relationships.

But for many entrepreneurs and marketers, CLV feels abstract. You’ve heard it’s important, but you may not know exactly how to calculate it, how to track it, or what to do with it.

This guide will fix that. We’ll walk you through five clear steps, taking you from “What is CLV?” to “How do I actively improve it?” You’ll learn what it is, why it’s a game-changing metric for any business, how to calculate it (without a math degree), and the most effective strategies to increase it.

Step 1: What Is Customer Lifetime Value (CLV)?

In simple terms, Customer Lifetime Value (CLV) is a prediction of the total net profit your business will earn from a single customer over the entire duration of their relationship with you.

It’s the ultimate “big picture” metric.

Instead of just looking at a customer’s first purchase ($50), CLV asks:

- How often will they come back?

- How much will they spend each time?

- How many years will they stay a customer?

A customer who makes a $50 purchase every month for 10 years is infinitely more valuable than a customer who makes a one-time $200 purchase and never returns. CLV is the metric that proves this.

It helps you answer the most critical question in business: How much is a new customer truly worth to me?

CLV vs. Other Metrics (And the Magic Ratio)

It’s helpful to see how CLV works with other key metrics.

CLV vs. Customer Acquisition Cost (CAC)

This is the most important relationship in business.

- Customer Acquisition Cost (CAC): How much it costs you (in marketing, sales, etc.) to get one new customer.

- Customer Lifetime Value (CLV): How much that customer is worth to you over time.

This leads to the magic ratio: The CLV:CAC Ratio.

This ratio tells you the health and long-term viability of your business model.

- A 1:1 ratio (CLV = CAC): You are losing money. You spend $100 to get a customer who only brings in $100 of profit.

- A 3:1 ratio (CLV = 3x CAC): This is widely considered the “sweet spot.” You are generating three times the value you spend to acquire it.

- A 5:1 ratio or higher: You’re doing great and likely under-investing in marketing. You can afford to spend more to grow faster.

Your goal is to increase CLV while keeping CAC as low as possible.

CLV vs. Average Order Value (AOV)

- Average Order Value (AOV): How much a customer spends on a single transaction, on average.

- CLV: How much they spend over their entire lifetime.

AOV is a component of CLV. You can increase your CLV by increasing your AOV (e.g., through upselling or product bundling), even if the customer’s lifespan stays the same.

Step 2: Why Customer Lifetime Value Is a Game-Changer for Your Business

If you only track sales, you’re flying blind. When you understand CLV, you unlock a new level of strategic decision-making. It’s not just a vanity metric; it’s a compass for growth.

It Shifts Your Focus from Acquisition to Retention

This is the most profound impact. When you don’t know your CLV, you treat all customers as equal. You spend all your energy on acquisition.

When you know your CLV, you realize that increasing customer retention by just 5% can increase profits by 25% to 95%, according to research from Bain & Company. (This is our authoritative external link!)

Suddenly, your budget for customer service, loyalty programs, and onboarding doesn’t look like a “cost”—it looks like an “investment.”

It Optimizes Your Marketing Spend

Once you know your CLV, you know exactly how much you can (and should) pay to acquire a new customer.

- Example: You run a subscription box service. You calculate that your average customer has a CLV of $450.

- Before CLV: You might panic that your Facebook ad CAC is $80.

- After CLV: You know that paying $80 to get $450 in profit is an incredible deal. You can confidently scale your ad spend, while your competitors (who don’t know their CLV) pause their campaigns because they think $80 is “too expensive” for a $50 first-month-free trial.

It Identifies Your Most Valuable Customers (VIPs)

Not all customers are created equal.

A small percentage of your customers likely drives a massive percentage of your profit. By calculating CLV, you can segment your audience and identify these “VIPs.”

Once you know who they are, you can:

- Roll out the red carpet to keep them happy.

- Offer them exclusive perks and early access.

- Analyze their behavior to find more customers like them.

It Improves Forecasting and Business Planning

CLV is a predictive metric. This makes your business forecasting far more accurate. Instead of just guessing next year’s revenue, you can build a model based on:

- Your current customer base

- Your average CLV

- Your projected retention rate

- Your new customer acquisition goals

This is how you build a predictable, scalable business that investors and stakeholders love.

It Guides Product Development

Want to know what new feature or product to build next? Ask your high-CLV customers.

The features and products that your most loyal and profitable customers want are the ones that will likely create more loyal and profitable customers. CLV data cuts through the noise of feature requests from low-value, high-churn users and helps you focus on what matters.

Step 3: How to Calculate Customer Lifetime Value (3 Simple Ways)

This is the part that often scares people away. But you don’t need to be a data scientist. You can start simple and get more complex as you grow.

Let’s use a simple, running example: A local coffee shop.

Method 1: The Simple (Historic) CLV Formula

This is the easiest way to get a baseline. It looks at a customer’s past behavior to estimate their value.

Formula: CLV = (Average Order Value) x (Average Purchase Frequency) x (Average Customer Lifespan)

Let’s break it down for our coffee shop:

- Average Order Value (AOV): You look at your data and find the average customer spends $7 per visit.

- Average Purchase Frequency: You find your regulars come in 4 times per week.

- Average Customer Lifespan: You see that your average loyal customer stays with you for 2 years.

Calculation:

- First, find the value per week:

$7 (AOV) x 4 (visits) = $28 per week - Then, find the value per year:

$28 x 52 weeks = $1,456 per year - Finally, find the total CLV:

$1,456 x 2 years = $2,912

Pros: Very easy to calculate with basic sales data. Cons: It’s historic. It assumes the future will be exactly like the past, which is never true. It doesn’t account for changes in customer behavior or inflation.

Method 2: The Traditional (Predictive) CLV Formula

This method is more complex but much more accurate. It’s predictive and accounts for profit margins and customer churn.

Formula: CLV = (Average Gross Margin per Customer) x (Retention Rate / (1 + Discount Rate - Retention Rate))

Whoa, that’s a lot. Let’s break it down for a different example: A $20/month SaaS (Software-as-a-Service) company.

- Average Gross Margin per Customer: Your $20/month subscription isn’t pure profit. After server costs, support, etc., you make an 80% gross margin.

$20/month x 12 months = $240/year$240 x 80% margin = $192 (This is your Average Gross Margin per Customer per year)

- Retention Rate: You measure your data and find that 75% of your customers stay with you year-over-year.

- Discount Rate: This is an accounting term (also called “cost of capital”) to reflect that a dollar today is worth more than a dollar next year. A standard rate to use is 10%.

Calculation:

- Numerator:

75%(Retention Rate) =0.75 - Denominator:

1 + 0.10 - 0.75=0.35 - Put it together:

$192 (Margin) x (0.75 / 0.35) $192 x 2.14- CLV = $410.88

This predictive number is far more “real” and useful for financial planning than the simple historic method.

Method 3: The “Good Enough” CLV for Beginners

Feeling overwhelmed by Method 2? Don’t be. Here’s a pragmatic “good enough” starting point that’s still forward-looking.

Formula: CLV = (Average Annual Profit per Customer) x (Average Customer Lifespan in Years)

This is the most practical of all.

- Average Annual Profit per Customer: Look at your data. How much profit (not revenue) does the average customer generate in one year? Let’s say it’s $150.

- Average Customer Lifespan: How long does the average customer stick around? Let’s say it’s 3 years.

Calculation:

$150 (Annual Profit) x 3 (Years)- CLV = $450

This number is now your north star. You know you can spend up to $450 to acquire a new customer and still break even in the long run. This simple calculation gives you the confidence to make smarter decisions today.

Step 4: The “What Next?” Problem: How to Actually Track CLV

A formula on a napkin is useless. A one-time calculation in a spreadsheet is already out of date.

The real power of CLV comes from tracking it in real-time. When you see your CLV trend up or down, you can react. But this is where most businesses get stuck.

The Spreadsheet Method (And Why It Fails)

You can try to track CLV in Excel or Google Sheets. This is a great place to do your first calculation. But it’s a terrible long-term solution.

- It’s manual and error-prone.

- It’s not connected to your live sales data.

- Nobody on your team will look at it.

It’s a “dead” number.

The Off-the-Shelf CRM Problem

The next step is to buy a big, expensive Customer Relationship Management (CRM) tool. The problem is that many of these tools are bloated, complex, and designed for enterprise-level companies.

They might not track your specific inputs correctly. You end up paying thousands of dollars for a complex dashboard that you don’t even use, and you still can’t find your simple CLV number.

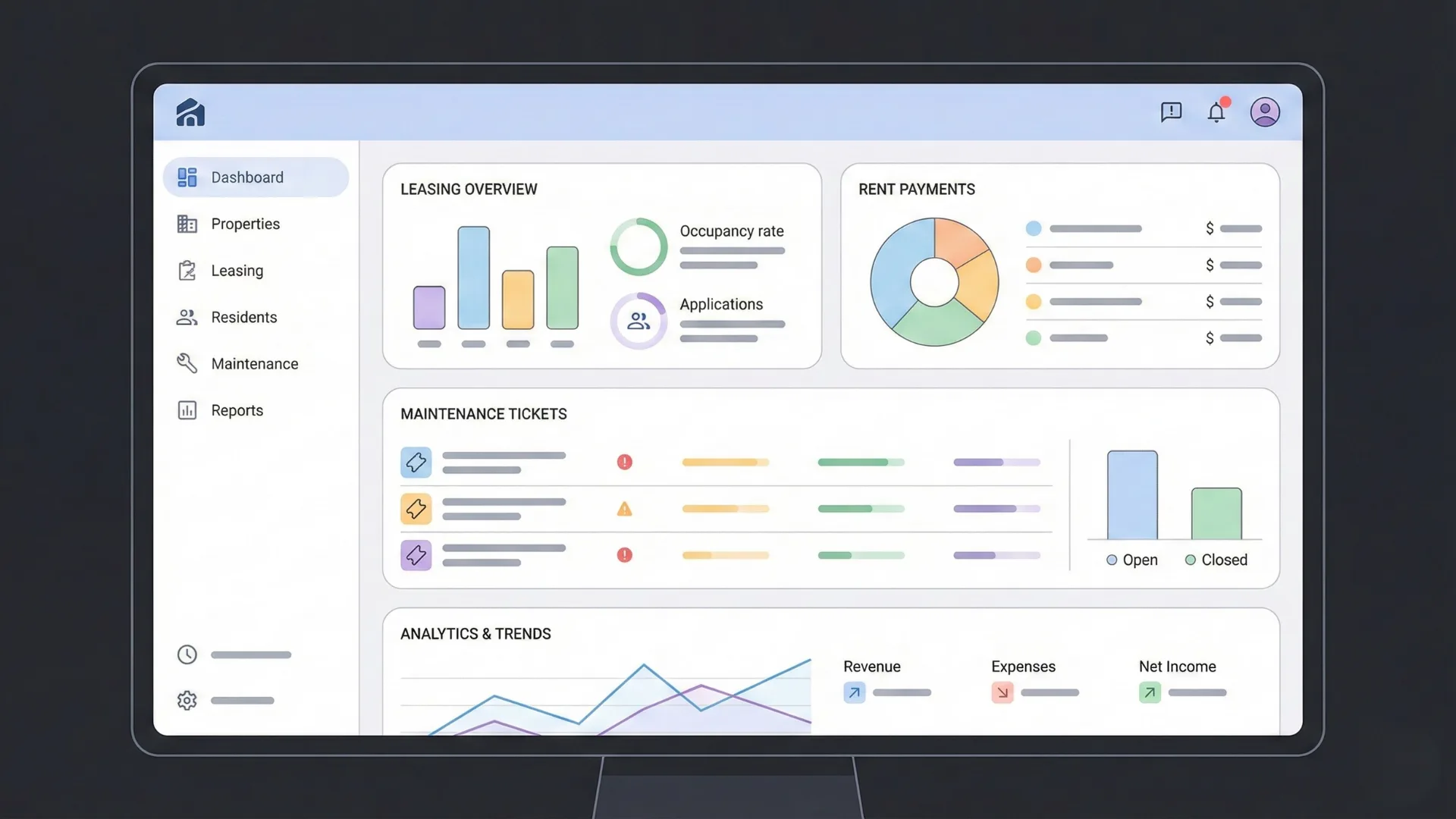

The Modern Solution: Building Your Own Tools (Without Code)

This is where the business landscape has fundamentally changed. You no longer need to choose between a dumb spreadsheet and an expensive, bloated CRM.

You can now build your own internal tools and dashboards to track exactly what you need.

This is where a platform like Imagine.bo becomes a superpower for a growing business. Imagine describing what you want in plain English:

“I need a simple dashboard that connects to my Stripe and Shopify data. It should show me four live numbers: Average Order Value, Purchase Frequency, Customer Churn Rate, and my real-time CLV.”

The AI-powered no-code builder can generate this custom tool for you. It’s not a generic dashboard; it’s your dashboard, built for your business logic. This approach, powered by no-code platforms, turns CLV from a static, academic number into a live, breathing KPI that your entire team can rally around. It bridges the gap between knowing the formula and using the insight.

Step 5: 5 Actionable Strategies to Increase Your Customer Lifetime Value

Now for the most important part. Once you’re tracking CLV, how do you make that number go up?

Increasing CLV is a “full-funnel” activity. It involves marketing, sales, product, and support. Here are five of the most effective, universal strategies.

Strategy 1: Create a World-Class Onboarding Experience

A customer’s first 30-90 days will determine if they stay for life or churn out. A poor onboarding experience creates confusion and buyer’s remorse. A great one builds loyalty from Day 1.

- What it is: A structured process that welcomes new customers and guides them to their “first win” (the “Aha!” moment) as quickly as possible.

- Actionable Steps:

- Personalized Welcome Email Series: Don’t just send one receipt. Send a 3-5 email series that introduces your brand, shows them how to get started, and offers help.

- A “First Win” Checklist: For a SaaS product, this could be “1. Create project, 2. Invite teammate, 3. Complete first task.” For an e-commerce product, it could be “1. How to wash your new shirt, 2. Style guide on what to wear it with.”

- Proactive Help: Don’t wait for them to get stuck. Offer a link to your help center, a “book a demo” call, or a support email.

Strategy 2: Implement a Loyalty or Rewards Program

This is the most direct way to increase Purchase Frequency. Rewarding customers for staying loyal gives them a clear, tangible reason to choose you over a competitor.

- What it is: A system that gives customers points, discounts, or perks for making repeat purchases.

- Actionable Steps:

- Points System: The classic model. “Spend $1, get 1 point. 100 points = $5 off.” Simple and effective.

- Tiered VIP Program: This is how Starbucks and Sephora dominate. The more you spend, the higher your “tier” (e.g., Bronze, Silver, Gold). Higher tiers unlock better perks, like free shipping, early access to new products, or a dedicated support line. This “gamifies” loyalty.

- Surprise & Delight: Don’t just reward transactions. Send your best customers a surprise gift on their birthday or on their 1-year “anniversary” with your brand.

Strategy 3: Master Upselling and Cross-Selling

This strategy is focused on increasing your Average Order Value (AOV). A small bump in AOV has a huge impact on your total CLV.

- Upselling: Persuading a customer to buy a more expensive version of a product. (e.g., “Get the Large fries for only 50 cents more.”)

- Cross-Selling: Persuading a customer to buy a related or complementary product. (e.g., “Customers who bought this laptop also bought a mouse.”)

- Actionable Steps:

- “You Might Also Like…”: Add this section to your product and checkout pages.

- Product Bundling: Offer a “starter kit” or “complete package” that bundles several products together for a slightly lower price than buying them separately.

- Post-Purchase Offers: After a customer buys, use the “Thank You” page to offer a one-time, time-sensitive add-on. “Add this for 20% off, good for the next 10 minutes only!”

Strategy 4: Deliver Proactive, Exceptional Customer Support

Bad customer support is the #1 driver of churn. Great customer support is one of the biggest drivers of retention.

The key is to shift your support team from being a “cost center” (just fixing problems) to a “retention engine” (creating happiness and loyalty).

- What it is: A support system that is fast, friendly, helpful, and, most importantly, proactive.

- Actionable Steps:

- Offer Multi-Channel Support: Be available where your customers are (email, live chat, social media).

- Build a Knowledge Base: Create a simple, searchable FAQ or help center. This empowers customers to help themselves 24/7 and reduces your support tickets.

- Build a Custom Support Portal: This is another area where modern tools can help. Instead of using a clunky, generic help desk, you could use Imagine.bo to build a simple, branded portal where your customers can easily submit tickets, track their status, and access a knowledge base tailored to them. This makes them feel valued and in control.

Strategy 5: Actively Collect and Implement Customer Feedback

The best way to know how to keep customers longer is to ask them. Building a formal “feedback loop” shows customers you care and gives you a free roadmap for improvement.

- What it is: A systematic process for gathering, analyzing, and acting on customer feedback.

- Actionable Steps:

- Net Promoter Score (NPS) Surveys: Send a simple, one-question survey: “On a scale of 0-10, how likely are you to recommend us?” This segments your customers into Promoters, Passives, and Detractors.

- Post-Purchase Surveys: 1-2 weeks after a purchase, send a simple survey. “How was your experience? What could we do better?”

- Close the Loop: This is the most critical part. When you get feedback (especially negative feedback), respond. And when you make a change based on feedback, announce it! “You asked, we listened. We’ve now added [New Feature]!”

Conclusion: Stop Chasing, Start Nurturing

Customer Lifetime Value isn’t just another acronym to track. It’s a fundamental shift in business philosophy.

It forces you to stop thinking in terms of one-off sales and to start thinking in terms of long-term relationships. It’s the difference between building a business that’s constantly scrambling for its next sale and building one that has a stable, predictable, and profitable foundation.

You don’t need a team of data scientists to get started.

Your first step is simple: use the “Good Enough” formula to get your baseline CLV this week. The number you find will immediately change how you think about your marketing, your product, and your customer service.

And when you’re ready to stop guessing and start tracking this metric in real-time, remember that the tools to do so are more accessible than ever. Instead of getting locked into an expensive CRM you don’t need, explore how an AI-powered no-code platform like Imagine.bo can help you build your perfect customer dashboard in hours, not months.

Start today. Your most valuable customers are waiting.

Launch Your App Today

Ready to launch? Skip the tech stress. Describe, Build, Launch in three simple steps.

Build