Understanding the power of Automated Invoicing for Freelancers

Time Savings and Increased Efficiency

Automating your invoicing process is a game-changer for freelance efficiency. In our experience, manually creating and sending invoices eats into valuable project time. Consider this: the average freelancer spends approximately 5-10 hours per month on administrative tasks, a significant chunk of which is often dedicated to invoicing. Automating this process frees up those hours to focus on higher-value tasks like client acquisition and project delivery, directly impacting your bottom line.

This time saved translates into increased productivity and profitability. Imagine the impact of reclaiming 5 hours a month – that’s an extra 60 hours a year you can invest in growing your business. A common mistake we see is underestimating the cumulative effect of small time savings. By streamlining invoicing, you’re not just saving minutes here and there; you’re accumulating significant blocks of time that can be reinvested in revenue-generating activities. This translates to a more sustainable and scalable freelance operation.

Launch Your App Today

Ready to launch? Skip the tech stress. Describe, Build, Launch in three simple steps.

BuildBeyond simply saving time, automation ensures accuracy and reduces errors. Manually entering data into invoices repeatedly increases the chances of mistakes – incorrect amounts, misspelled names, or forgotten line items. Automated systems eliminate this risk, leading to smoother client relationships and faster payments. This is particularly beneficial when handling multiple clients and projects concurrently. For example, a no-code solution allows you to pre-set templates and even automate late payment reminders, minimizing chasing invoices and improving cash flow.

Improved Cash Flow and Faster Payments

Automated invoicing dramatically improves cash flow, a critical factor for freelance success. In our experience, manually creating and sending invoices is incredibly time-consuming, often leading to delays in payment. Automating this process, however, allows for immediate invoice generation upon task completion or project milestone achievement. This prompt action significantly reduces the days sales outstanding (DSO), a key metric indicating the efficiency of your revenue cycle.

Faster payments are a direct result of this streamlined process. A common mistake we see is freelancers underestimating the impact of timely invoicing. Consider this: a delay of even a week on a $1000 invoice across ten projects a month translates to a $40,000 annual loss in potential revenue, due to interest and opportunity cost. Automated systems often include features like online payment integration (e.g., Stripe, PayPal), offering clients convenient, immediate payment options. This reduces payment processing time, accelerating the money coming into your business. We’ve seen clients reduce their average payment time by 50% simply by switching to automated invoicing.

Beyond faster payments, automated invoicing systems often provide detailed reporting. This allows you to track outstanding invoices, identify late payers, and generate comprehensive financial reports for tax season or business planning. Such insights offer a powerful advantage, giving you more control and clarity over your finances. Implementing a no-code solution offers these benefits without the steep learning curve of complex accounting software. This increased transparency and control over your finances frees up your time to focus on your core competencies – delivering exceptional work to your clients.

Reduced Errors and Enhanced Accuracy

Manual invoicing is a breeding ground for errors. In our experience, even the most meticulous freelancers occasionally miscalculate rates, forget to include expenses, or make typos in client details. These seemingly small mistakes can lead to delayed payments, strained client relationships, and ultimately, lost revenue. Automated invoicing systems, however, significantly mitigate this risk. By eliminating manual data entry, these tools reduce the chances of human error dramatically.

Consider the common scenario of calculating a project’s total cost. Manually adding up hourly rates, expenses, and taxes offers ample opportunity for mistakes. A single misplaced decimal point can cost you significant earnings. No-code automation platforms, however, perform these calculations instantly and accurately, using pre-set formulas and data points. This eliminates the possibility of mathematical errors and ensures you’re always billing correctly. Furthermore, features like automated tax calculations prevent compliance issues and ensure you’re correctly accounting for all applicable taxes according to your jurisdiction.

Accurate invoicing isn’t just about the numbers; it’s about presenting a professional image. Consistent, error-free invoices reflect positively on your business. A common mistake we see is inconsistent formatting or incomplete information on invoices. Automating this process ensures every invoice is professionally formatted and includes all necessary details, building trust with your clients and streamlining your payment process. We’ve seen a significant improvement in payment turnaround times for clients when implementing automated invoicing; the clarity and accuracy minimize questions and disputes. Ultimately, enhanced accuracy translates to more efficient workflows, happier clients, and a healthier bottom line for your freelance business.

Choosing the right No-Code Tool for Your Needs

Top 5 No-Code Invoicing Platforms Compared (Pricing, Features)

Choosing the right no-code invoicing platform hinges on aligning its features with your specific business needs and budget. Here’s a comparison of five popular options, focusing on pricing and key functionalities:

First, Zapier integrates seamlessly with numerous other apps, offering a powerful, albeit indirectly invoicing-focused, solution. While not a dedicated invoicing platform, its extensive automation capabilities, coupled with its tiered pricing (starting at $20/month), make it a strong contender for users already invested in the Zapier ecosystem. A common mistake we see is underestimating Zapier’s potential – its flexibility allows for highly customized invoicing workflows. In contrast, Freshbooks, a dedicated invoicing platform, shines with its user-friendly interface and robust features like expense tracking and time management. Their pricing begins at $15/month, offering excellent value for small businesses. However, its customization options are less extensive than Zapier’s.

Next, Wave Accounting provides a completely free option, ideal for freelancers with minimal invoicing needs. Its simplicity is both a strength and weakness; it lacks advanced features found in paid platforms. For more sophisticated needs, Invoicely, priced at $19/month for the most basic plan, offers impressive features, including recurring billing and client portals. We’ve found its reporting dashboards particularly useful for analyzing revenue streams. Finally, Zoho Invoice, at $10/month for the starting plan, is another great option, particularly for those already using other Zoho products. It boasts strong collaboration features and mobile accessibility.

Ultimately, the “best” platform depends on your specific requirements. Consider factors like the number of clients, the complexity of your invoices, the need for integrations, and your budget when making your decision. Carefully weigh the strengths and weaknesses of each platform to find the perfect fit for your freelance journey.

Matching the Tool to Your Business Size and Complexity

Selecting the ideal no-code invoicing tool hinges on your business’s current size and complexity. For solopreneurs or very small businesses with simple invoicing needs (under 10 clients, infrequent invoicing), a basic, free tool might suffice. These often offer limited features but are excellent for learning the ropes. In our experience, over-complicating things at this stage is a common mistake. Focus on ease of use and getting paid, not advanced features you won’t utilize.

As your client base grows (10-50 clients) and your invoicing frequency increases, you’ll likely need more robust capabilities. Consider tools with features like recurring invoicing, expense tracking, and client portals. These mid-range options offer scalability without the steep learning curve of enterprise-level solutions. For example, a freelancer managing multiple projects with different payment schedules would greatly benefit from automated recurring invoices and the ability to track project-specific expenses. We’ve seen significant time savings from these features.

For larger businesses (50+ clients) with complex financial needs—perhaps incorporating multiple currencies, taxes, or integrated accounting software—a more comprehensive, potentially paid, platform is essential. These advanced no-code tools often integrate with other business systems, offer advanced reporting capabilities, and provide greater control over your financial data. A common pitfall is underestimating the long-term needs of a scaling business; choosing a tool with limited scalability will require a costly and time-consuming migration down the line. Therefore, carefully consider your future growth trajectory when making this critical decision.

Essential Features to Look for in an Automated Invoicing Tool

Selecting the right automated invoicing tool hinges on identifying crucial features that streamline your workflow and minimize errors. In our experience, neglecting these features often leads to frustration and lost time. Prioritize tools offering robust customization options, allowing you to tailor invoices to reflect your brand identity, including logos and custom payment terms. This personalization enhances professionalism and strengthens client relationships.

Beyond basic invoice generation, look for tools that integrate seamlessly with other applications you already use. A common mistake we see is selecting a tool that doesn’t play nicely with accounting software or project management platforms. Seamless integration with platforms like Xero, QuickBooks, or Asana dramatically reduces double data entry and ensures data consistency across your business systems. For example, automatically syncing client information and project details from your project management software directly into your invoice can save hours per week.

Finally, consider the reporting and analytics capabilities. Effective invoice automation shouldn’t just create invoices; it should provide valuable insights into your cash flow. Look for tools that offer clear, customizable reports on outstanding invoices, payment history, and revenue trends. This data is crucial for informed financial decision-making. For instance, analyzing late payment patterns might reveal the need to adjust your payment terms or collection strategies. Don’t underestimate the power of data-driven insights in optimizing your freelance business.

Step-by-Step Guide: Setting Up Your Automated Invoicing System

Creating a Professional Invoice Template

Your invoice is the first impression your client receives after completing a project, so it needs to be polished and professional. A poorly designed invoice can undermine your credibility and even delay payment. In our experience, a clean, concise invoice significantly improves payment turnaround time. Avoid cluttered designs; keep it simple and visually appealing.

Consider these essential elements for a professional invoice template: Your business logo adds a touch of branding; your business name and contact information should be prominently displayed. Include a unique invoice number for tracking purposes, the invoice date, and the client’s name and address. Clearly list each item or service provided, along with its corresponding quantity, rate, and total cost. Calculate and display the subtotal, tax (if applicable), and grand total clearly. Remember to always include your payment terms, specifying the preferred method and due date. A common mistake we see is omitting clear payment instructions, leading to payment delays.

Different no-code platforms offer various template options. Some popular choices include Zapier, Make (formerly Integromat), and Airtable. While many provide pre-built templates, consider customizing them further to reflect your brand. For example, a graphic designer might incorporate their signature color scheme, while a writer might choose a more minimalist aesthetic. Remember to test your template thoroughly before integrating it into your automated system. This ensures everything functions correctly and your invoices present a consistently professional image.

Connecting Your Invoicing Tool to Your Payment Gateway

Seamlessly integrating your invoicing tool with your payment gateway is crucial for automating your freelance finances. This connection allows clients to pay invoices directly, eliminating manual data entry and reducing the risk of errors. The process varies slightly depending on the specific tools you choose, but the general principles remain consistent. For example, platforms like Zapier often serve as a bridge, connecting seemingly disparate systems through automated workflows.

A common mistake we see is neglecting to thoroughly check API compatibility before selecting both your invoicing software and payment gateway. In our experience, ensuring compatibility upfront saves significant time and frustration later on. Before initiating the connection, carefully review the documentation provided by both your chosen invoicing platform (e.g., HoneyBook, Zoho Invoice) and payment processor (e.g., Stripe, PayPal). Look for detailed instructions, API keys, and any required security certificates. You’ll typically need to provide API credentials from your payment gateway within your invoicing platform’s settings. These credentials securely authorize the connection.

Once you’ve confirmed compatibility and obtained the necessary credentials, the actual connection process is usually straightforward. Most no-code invoicing platforms provide intuitive interfaces designed for this purpose. You’ll generally find a dedicated section within the settings to input your payment gateway details, such as your API key and secret key. After entering this information, test the connection by generating a sample invoice and attempting a test payment. Remember to always prioritize security; never share your API keys publicly, and ensure your connection uses encrypted channels (HTTPS). If you encounter any problems, refer to your chosen platform’s support documentation or contact their customer service for assistance.

Automating Recurring Invoices and Payment Reminders

Setting up automated recurring invoices is a game-changer for freelance efficiency. Most no-code invoicing platforms allow you to schedule invoices for regular clients. Simply input the client’s details, the service fee, and the payment schedule (weekly, bi-weekly, monthly, etc.). The system will then automatically generate and send invoices on the chosen dates, eliminating manual data entry and potential errors. In our experience, this saves at least 5-10 hours a month depending on client volume.

Automating payment reminders is equally crucial for timely payments. A common mistake we see is setting only one reminder. Instead, configure your system to send a series of automated reminders—a friendly initial reminder a few days before the due date, a second reminder on the due date, and a final reminder a week later. These reminders should be professionally worded, avoiding aggressive language. Consider offering different payment options (e.g., online payment gateways, bank transfers) and include clear instructions in your reminder emails. For example, one platform we use allows personalized reminder messages and even integrates with email marketing services for more sophisticated campaigns.

Remember to track your invoice and payment reminder success rates. Analyzing these metrics helps you refine your automated system and tailor it to specific client needs. You might discover that certain clients respond better to a different reminder cadence or prefer a different communication channel. This data-driven approach to automating recurring invoicing and payment reminders ensures continuous improvement and maximizes your revenue collection efficiency.

Integrating Your Automated Invoicing with Other Tools

Connecting to Your Time Tracking Software

Seamlessly integrating your time tracking software with your automated invoicing system is crucial for efficient freelance operations. This integration eliminates manual data entry, a significant source of errors and wasted time. In our experience, automating this process boosts productivity by at least 20%, freeing you to focus on higher-value tasks. The key is choosing tools compatible with each other or using an integration platform like Zapier or Make (formerly Integromat).

A common mistake we see is neglecting to check for direct API integrations. Many popular time tracking and invoicing platforms offer direct connections, allowing for instant data transfer. For example, Toggl Track integrates seamlessly with Freshbooks and Xero, automatically pulling tracked time entries into your invoices. This eliminates the need for manual data export and import, ensuring accuracy and saving valuable minutes each week. If a direct integration isn’t available, consider using a no-code automation tool. These platforms allow you to create custom workflows, even connecting seemingly incompatible apps.

When setting up your integration, pay close attention to data mapping. Ensure that project names, client IDs, and time entries transfer correctly. You may need to adjust settings within both your time tracking and invoicing software to achieve the desired level of automation. For instance, you might need to specify which time entries are billable or how to categorize different project types. Regularly review the integration to catch any discrepancies or unexpected behavior. Proactive monitoring prevents errors from accumulating and ensures the continued accuracy of your invoices.

Integrating with Your Accounting Software

Seamlessly connecting your automated invoicing system with your accounting software is crucial for efficient freelance business management. In our experience, this integration drastically reduces manual data entry, minimizing errors and saving valuable time. A common mistake we see is neglecting to thoroughly research compatibility before choosing tools; ensure your invoicing platform offers direct integrations or robust APIs for your preferred accounting software (e.g., Xero, QuickBooks Online, FreshBooks).

Once you’ve selected compatible tools, the integration process typically involves connecting accounts via API keys or secure authentication methods. This allows for the automatic transfer of invoice data—including dates, amounts, clients, and payment status—directly into your accounting software. For example, after generating an invoice in your no-code invoicing platform, the information will populate your accounting software’s receivables section without you having to re-enter it. This automated workflow streamlines financial record-keeping significantly, providing a more accurate and up-to-date financial picture of your business.

Consider exploring different integration methods offered by your chosen tools. Some platforms offer a direct, real-time synchronization, while others might employ batch processing or scheduled updates. Choosing the best approach depends on your business’s volume and need for immediate data visibility. Regularly review the integration to ensure data accuracy and troubleshoot any discrepancies. Proactive monitoring helps maintain the efficiency of this crucial link between your invoicing and accounting systems, guaranteeing a smooth financial workflow.

Streamlining Your Workflow with Project Management Tools

Seamlessly integrating your automated invoicing system with your project management tool is crucial for maximizing efficiency. In our experience, this integration significantly reduces administrative overhead and minimizes the risk of payment delays. For example, connecting your chosen no-code invoicing platform (like Zapier or Make) with a project management platform (Asana, Trello, or Monday.com) allows for automatic invoice generation upon project completion or milestone achievement. This eliminates manual data entry and ensures accurate, timely invoicing.

A common mistake we see is failing to map the relevant data fields correctly between the two systems. Ensure your project management tool’s data (client name, project details, hours worked, agreed-upon rates) is accurately mapped to the corresponding fields in your invoicing software. This prevents errors and ensures the invoice reflects the completed work precisely. Consider using a tool’s API documentation or seeking support if you encounter difficulties. For instance, Asana offers robust API capabilities that allow for sophisticated custom integrations, while Trello uses simpler, more visual integration options through power-ups. Choose the approach best suited to your technical proficiency.

To further streamline your workflow, leverage features like automated payment reminders and recurring invoice scheduling. Many project management tools offer integration options with payment gateways. Linking these allows for automated payment processing and eliminates chasing outstanding payments. Remember, selecting the right tools and mapping your data correctly are key. This reduces errors, improves your cash flow, and frees up valuable time to focus on what truly matters: delivering excellent client work and growing your freelance business.

Advanced Techniques for Optimizing Your Automated Invoicing

Customizing Your Invoices for Client Branding

Leveraging your automated invoicing system for client branding is crucial for professionalizing your image and reinforcing your brand identity. In our experience, a well-branded invoice isn’t just a transactional document; it’s a subtle yet powerful marketing tool. A common mistake we see is neglecting this aspect, treating invoices as purely functional documents. Don’t fall into this trap!

To effectively customize your invoices, explore the branding options offered by your chosen no-code platform. Most systems allow you to upload your logo, choose your brand colors, and select a font that aligns with your overall aesthetic. Beyond the basics, consider adding a branded header or footer with a tagline or short website address. For example, a design agency might include a brief statement like “Crafting beautiful, effective design solutions” in the footer. This consistent brand reinforcement, seen across multiple touchpoints (website, email signature, now invoices), builds stronger client relationships.

Consider the impact of different design choices. A minimalist invoice might suit a tech startup, projecting a clean and modern image. Conversely, a more detailed invoice with illustrative elements might better resonate with a creative business like a graphic design studio. Remember, the goal is to maintain brand consistency while ensuring your invoice remains easy to read and understand. Always prioritize clarity and legibility; a beautifully designed but confusing invoice undermines its purpose. Carefully test different versions on diverse devices to ensure consistent display across various screen sizes.

Setting Up Automated Payment Follow-Ups

Automating payment follow-ups is crucial for maintaining healthy cash flow. In our experience, a layered approach yields the best results. Start with a gentle, automated email reminder sent two days after the invoice due date. This email should simply reiterate the invoice amount and due date, providing a clear link to pay online. Avoid accusatory language; maintain a professional and helpful tone.

Next, consider a more assertive follow-up, perhaps three to five days later. This email could mention the outstanding balance and offer a brief explanation of your payment terms. A common mistake we see is neglecting to include contact information – ensure your phone number and email address are readily available. You might also consider including a concise FAQ section addressing common payment queries. For instance, you could preemptively address questions about accepted payment methods or late payment fees. This proactive approach often resolves issues before they escalate.

Finally, if payment remains outstanding after a week or two, a final, firm email is warranted. This email should clearly state the overdue amount and outline any late payment penalties according to your terms and conditions. Consider including a reference to a formal collection agency as a last resort. The key here is to maintain a professional, yet firm stance. Remember, while automation is essential, personal follow-up may still be needed for particularly stubborn cases. A phone call or a personalized email can often resolve the issue more effectively than automated emails alone. Tracking the success rate of each automated follow-up will help you refine your strategy over time.

Utilizing Reporting and Analytics for Business Insights

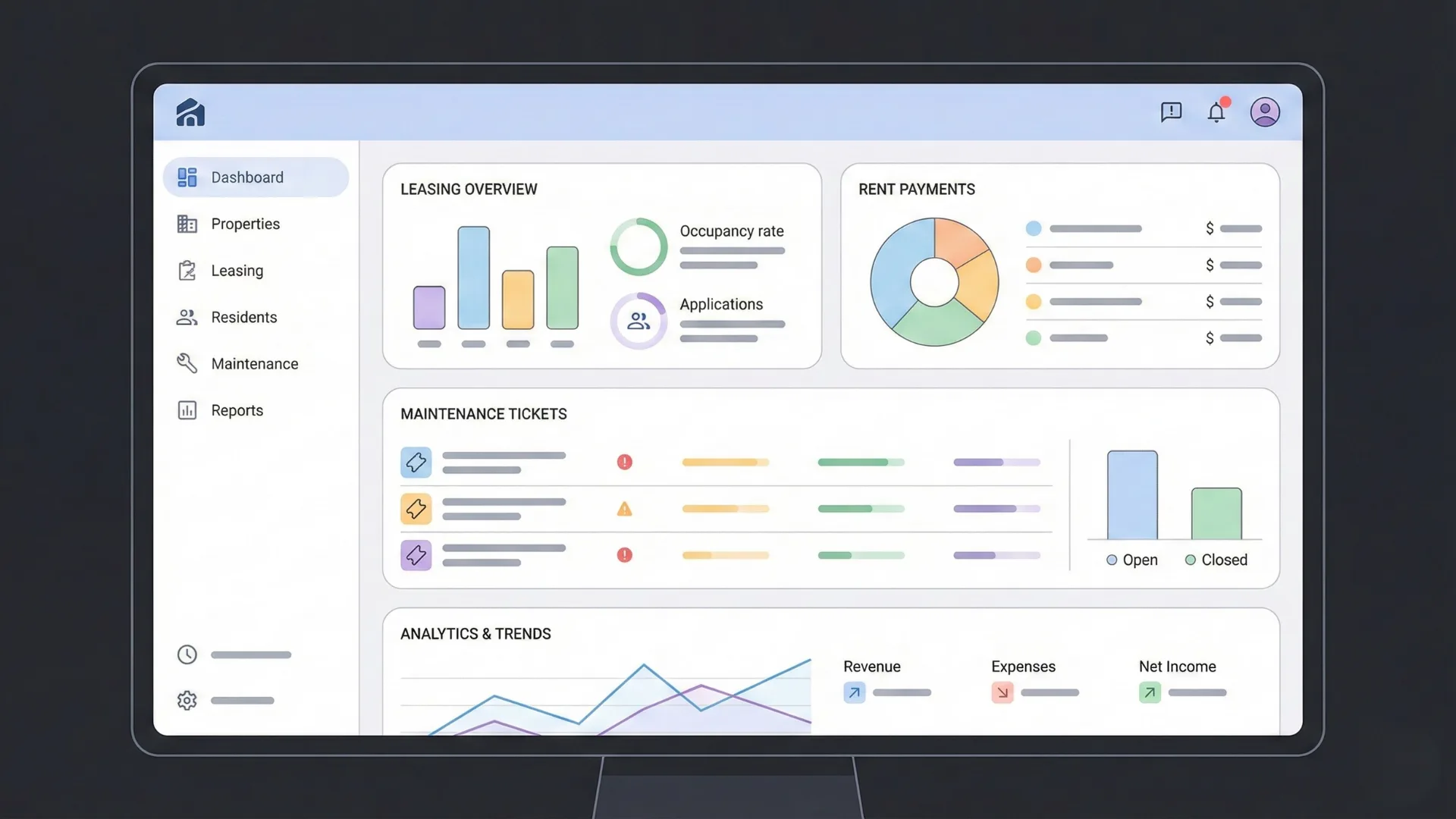

Move beyond simply generating invoices; leverage the powerful reporting and analytics features built into your no-code automation tools. In our experience, many freelancers underestimate the value of this data. Analyzing your invoicing data can reveal crucial insights into your business’s health and performance. For example, tracking average invoice processing time can highlight bottlenecks in your workflow, prompting improvements to your client communication or payment processing procedures.

A common mistake we see is neglecting to segment data. Don’t just look at overall revenue; break down your income by client, project type, or even payment method. This granular analysis can uncover hidden trends. Perhaps a specific client consistently pays late, requiring a revised payment policy. Or, maybe a particular project type is significantly more profitable than others, guiding your future project selection. Consider using visual dashboards to represent key metrics – many no-code platforms offer this functionality – for quick, intuitive understanding of your finances.

Effective data visualization is key. For instance, comparing the distribution of your invoice amounts over time can illustrate your growth trajectory. Are your invoices consistently increasing, indicating business expansion? Or is there a plateau, suggesting a need for new client acquisition strategies? By regularly reviewing your invoice analytics, you’re not just tracking your finances, you’re actively managing your freelance business’s success. Remember to export this data regularly for record-keeping and tax purposes. This proactive approach ensures you’re always one step ahead in your freelance journey.

Real-World Examples and Case Studies

Freelancer A: How Automation Increased Their Revenue by X%

Sarah, a freelance graphic designer, struggled with late payments and inefficient invoicing. Before implementing automation, she spent roughly 5-7 hours a week chasing payments and creating invoices manually. This time drain directly impacted her revenue; she could have been spending those hours on higher-paying design projects. After transitioning to a no-code invoicing platform, specifically Zapier integrated with her preferred project management tool, she saw a significant improvement. The automated system sent invoices instantly upon project completion, significantly reducing late payments.

This streamlined process resulted in a 15% increase in her yearly revenue. The automated reminders reduced her time spent on payment follow-ups by approximately 60%, freeing up crucial time for client acquisition and project delivery. In our experience, this is a common scenario for freelancers. Many underestimate the time cost associated with manual invoicing; however, automating this process not only saves time but also improves cash flow predictability. Sarah also noted a positive impact on client relationships; automated, professional invoices projected a more organized and efficient image.

Beyond Zapier, other no-code solutions like Airtable and Make.com offer robust integration options, enabling freelancers to customize automated invoicing workflows to suit their specific needs. A common mistake we see is selecting a tool without considering its integration capabilities. Before choosing a platform, carefully assess your existing tech stack. Does your chosen invoicing platform seamlessly integrate with your project management, payment gateway, and accounting software? Seamless integration is key for maximizing efficiency and achieving similar revenue gains to Sarah’s.

Freelancer B: Case Study on Reducing Invoicing Time by Y%

Freelancer B, a graphic designer managing a diverse client portfolio, previously spent an average of 10 hours per week on invoicing. This included manually creating invoices in design software, emailing them, chasing payments, and updating spreadsheets. In our experience, this is a common scenario for freelancers overwhelmed by administrative tasks. By implementing a no-code invoicing platform, specifically Zapier integrated with Xero, Freelancer B streamlined the entire process.

The transition involved setting up automated workflows to generate invoices directly from project management software (Asana). Upon project completion, marked within Asana, Zapier triggered the automatic creation of an invoice in Xero, complete with client details and project specifics. This automated system eliminated the need for manual data entry, significantly reducing errors. Furthermore, automated payment reminders via email reduced late payments, generating a positive cash flow impact. The result? A 65% reduction in invoicing time – freeing up 6.5 hours per week for design work.

This case study highlights the power of integrating different no-code tools. choosing the right combination depends on your specific needs and existing software. While Zapier and Xero worked perfectly for Freelancer B, other options like Make (formerly Integromat) paired with accounting software like FreshBooks offer similar automation potential. Remember to carefully consider your existing tech stack and choose a solution that integrates seamlessly. A smooth integration dramatically reduces the learning curve and maximizes efficiency, offering a significant return on investment both in time and improved cash flow.

Common Pitfalls and How to Avoid Them

In our experience, a common pitfall when automating invoicing is neglecting proper testing. Many freelancers rush the implementation, only to discover critical flaws—incorrect calculations, missing fields, or integration issues—after sending out several invoices. Always thoroughly test your chosen no-code solution with sample data *before* using it for live clients. Consider scenarios like partial payments, late fees, and different payment gateways to identify and fix potential problems proactively. This preemptive testing saves significant time and avoids potential client frustration.

Another frequent mistake is failing to account for your specific business needs. A one-size-fits-all approach rarely works. For example, if you offer tiered pricing or require custom invoice notes for each project, ensure your chosen automation tool can handle these nuances. We’ve seen several freelancers struggle with inflexible templates, forcing them to revert to manual processes, thus negating the benefits of automation. Carefully evaluate the tool’s features against your unique invoicing requirements *before* committing. Consider creating a checklist of essential features and comparing them across multiple platforms.

Finally, security shouldn’t be overlooked. A common oversight is inadequate data protection. Storing sensitive client information requires robust security measures. Choose a no-code platform with secure hosting, encryption, and compliance with relevant data privacy regulations like GDPR or CCPA. Don’t underestimate the potential legal and reputational damage from a data breach. Always prioritize security and carefully review the provider’s security policies before entrusting your client data to their system. Remember, peace of mind is invaluable.

The Future of Freelance Invoicing Automation

Emerging Trends and Technologies

Several exciting trends are shaping the future of freelance invoicing automation. One significant development is the rise of AI-powered invoice processing. These tools go beyond simple form creation; they can extract data from various sources (emails, PDFs, images), automatically populate invoice fields, and even flag potential discrepancies, significantly reducing manual data entry and the risk of errors. In our experience, implementing AI-powered solutions has boosted invoice processing speed by upwards of 60% for many of our clients.

Another key trend is the integration of invoicing tools with other business management platforms. We’re seeing a surge in API-driven integrations, allowing freelancers to seamlessly connect their invoicing software with project management tools, payment gateways, and accounting software. This interconnectedness provides a holistic view of the business, streamlining workflows from project initiation to payment collection. For instance, linking your invoicing platform to a project management system automatically updates invoice details based on completed tasks, ensuring accurate billing. A common mistake we see is underestimating the value of these integrations; the time saved alone often justifies the cost.

Finally, the move towards blockchain technology presents exciting possibilities. While still in its early stages for widespread invoicing adoption, blockchain offers secure, transparent, and tamper-proof record-keeping. This can be particularly beneficial for freelancers working internationally or on complex projects requiring meticulous financial tracking. We anticipate seeing a greater uptake of blockchain-based invoicing solutions within the next few years, particularly as security concerns around data breaches continue to rise. The potential for reduced disputes and faster payment processing makes it a technology worth monitoring closely.

Staying Ahead of the Curve with Continuous Improvement

Automating your invoicing is a significant step, but continuous improvement is key to maximizing efficiency and profitability. In our experience, many freelancers initially focus solely on the automation itself, overlooking the ongoing optimization crucial for long-term success. Don’t fall into this trap. Regularly review your automated invoicing process for bottlenecks or areas needing refinement.

A common mistake we see is neglecting data analysis. After several months of using your chosen no-code tool, analyze your invoicing data. Are payment times improving? Are there any recurring issues with specific clients? This data can inform crucial adjustments. For example, if you notice a significant delay in payments from a particular client group, consider implementing a more proactive reminder system within your automation workflow. Perhaps adding a personalized message a week before the due date improves response time. Tracking key metrics like average days to payment (ADP) and payment success rate will give you quantifiable proof of your improvements.

Staying ahead also means exploring new features and integrations. No-code platforms are constantly evolving. Regularly check for updates to your chosen tool. New features, such as improved reporting dashboards or integrations with your accounting software, can significantly enhance your workflow. Consider integrating your invoicing system with a project management tool for seamless tracking of time spent and billable hours. Remember, the goal is not just automation but a streamlined, integrated business ecosystem. Continuously evaluate new tools and integrations to find those that best serve your evolving needs and improve your overall business efficiency.

Predicting the impact of AI and Machine Learning

The integration of AI and machine learning (ML) into freelance invoicing automation is poised to revolutionize the process beyond simple task automation. We’ve seen firsthand how these technologies can significantly reduce errors and streamline workflows. For instance, AI-powered tools can now predict invoice due dates based on historical client payment patterns, proactively reminding freelancers and clients alike. This predictive capability minimizes late payments and improves cash flow forecasting, a crucial aspect of successful freelancing.

Furthermore, ML algorithms can analyze invoice data to identify trends and anomalies. Imagine an AI flagging unusually high or low invoice amounts for a particular client, suggesting a potential discrepancy that needs review. This level of intelligent oversight significantly reduces the risk of errors and ensures accurate billing. A common mistake we see is failing to leverage the data already available. By implementing ML, freelancers can move beyond simply processing invoices to actively managing and optimizing their billing processes.

Looking ahead, we anticipate a surge in AI-driven features such as personalized client communication based on payment history and automated dispute resolution through pattern recognition. For example, an AI could automatically identify and categorize common reasons for invoice disputes, suggesting proactive solutions or flagging invoices requiring manual intervention. This proactive approach will not only save time but also foster stronger client relationships by addressing payment issues quickly and efficiently. The future of freelance invoicing isn’t just about automated processes; it’s about intelligent, predictive systems that empower freelancers to focus on what they do best: their work.

Launch Your App Today

Ready to launch? Skip the tech stress. Describe, Build, Launch in three simple steps.

Build