Stripe serves as the digital currency exchange for modern businesses, handling trillions of dollars in transactions. While its architecture is robust and highly reliable, every payment gateway can encounter occasional hiccups. For any business, especially one scaling rapidly, understanding the precise nature of these failures is the critical first step toward maintaining system integrity and a flawless customer journey. This guide offers a deep-dive into Stripe troubleshooting, focusing on both user-side and technical errors, and illustrates how next- generation development tools ensure maximum reliability.

1. Deeper Dive into Payment Failure Types

Stripe errors are usually categorized by their source: the cardholder, or the technical interaction between your platform and the Stripe API. A systematic understanding of these categories is key to accurate diagnosis.

Launch Your App Today

Ready to launch? Skip the tech stress. Describe, Build, Launch in three simple steps.

BuildCustomer-Side Declines and Issuer (Bank) Issues

These are the most common failures and often require direct customer communication or a change in payment method.

- Card Declined (Generic Refusal): This broad error means the customer’s issuing bank has refused the transaction for an unspecified reason. While the bank is the final authority, common causes include:

- Regional Restriction: The bank may block transactions originating from a foreign country or a new payment processor like Stripe.

- Fraud Prevention Trigger: A large or unusual transaction may trip the bank’s internal fraud algorithm.

- Address Verification System (AVS) Mismatch: If the billing address entered doesn’t match the one on file with the card issuer, the bank may decline the payment. Stripe signals these specific failures (e.g.,

incorrect_address). Understanding related compliance and protection guidelines is crucial for minimizing these declines.

- Expired Card: A straightforward error. However, for subscription-based models, this can lead to involuntary churn. Prevention: Implement a dunning process that sends automated emails 30, 15, and 7 days before the expiration date, prompting the customer to update their details via a secure portal. Stripe’s built-in tools can handle much of this, but your system needs to surface the UI for update easily.

- Incorrect Card Details (Typographical Errors): Mistakes in the card number, expiration, or CVC (Card Verification Code) are human errors. Prevention: Use Stripe Elements—Stripe’s pre-built UI components—which include real-time input validation and formatting, catching typos before the data is even submitted to your server. This client-side validation greatly improves success rates.

- Insufficient Funds: A simple lack of balance. Strategy: For recurring payments, consider using Stripe’s Smart Retries feature. This attempts to re-process the payment based on optimized timing, often increasing recovery rates without user intervention.

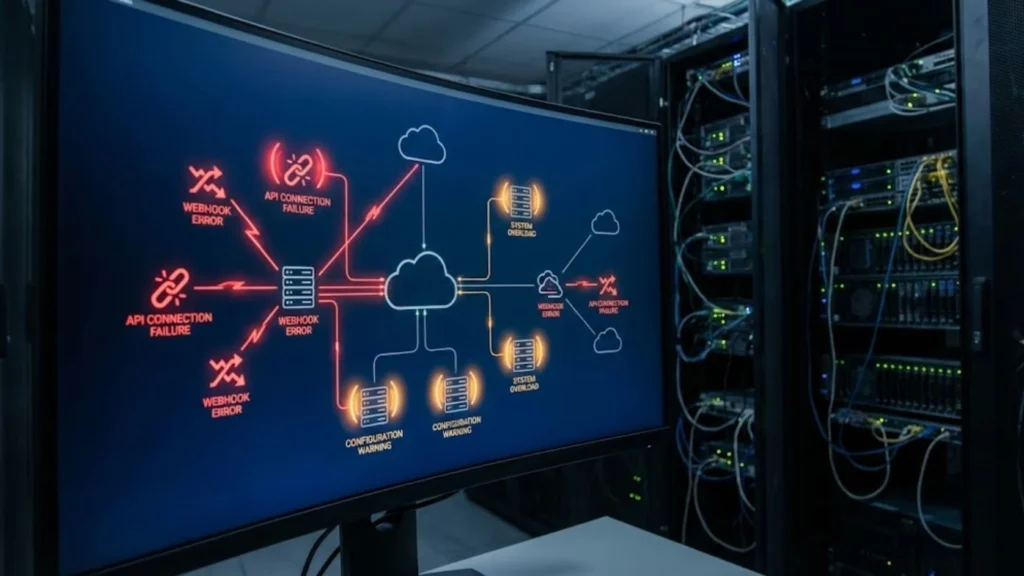

Systemic Technical Glitches and Integration Errors

These failures indicate an issue with your application’s environment, configuration, or communication protocols.

- API Errors (Configuration and Rate Limits): Errors can arise from using an outdated API version, incorrect API key usage (Test vs. Live), or exceeding Stripe’s operational limits.

- Version Mismatch: Stripe occasionally deprecates older API versions. Failure to update can break core payment logic.

- Rate Limiting: During high-volume periods (like a major sale), if your application hits the API too quickly, Stripe may temporarily throttle your requests, leading to 429 errors. Implementing exponential backoff logic in your server-side code is the standard defense against this.

- Webhook Issues: Webhooks are critical for receiving asynchronous event notifications (like successful payments, failures, or refunds) from Stripe. Failures here lead to data integrity and security issues.

- Endpoint Failure: Your server must respond with a

200HTTP status code to acknowledge the receipt of the webhook. If it fails, Stripe retries the delivery, potentially leading to duplication or data delay. - Signature Verification: Webhooks must be verified using Stripe’s signature headers to ensure the request is genuinely from Stripe and not a malicious third party. Incorrect verification code is a common integration flaw.

- Endpoint Failure: Your server must respond with a

- Server Communication Failures (Timeouts and Load): If your server is slow, overloaded, or has network issues, it can fail to complete the payment request within the typical 10-20 second timeout window. This is a critical issue that directly impacts customer trust and requires robust infrastructure built for speed and security.

2. Integrating for Reliability: The Imagine.bo Advantage in Payment Infrastructure

The fundamental reality is that technical errors are almost always caused by human mistakes during configuration, poor code integration, or inadequate server provisioning. The best troubleshooting is prevention, and this is where an AI-powered, no-code app development platform like Imagine.bo: AI No-Code App Builder changes the game.

As an Imagine.bo user, you leverage a system engineered for inherent stability, tackling the biggest integration pain points directly:

- AI-Driven, Zero-Error Configuration: When you instruct the AI to “add Stripe payment processing for subscriptions,” Imagine.bo doesn’t just add a UI button; it automatically generates and secures the entire integration stack. This includes:

- Correct API Versioning: The AI ensures the use of the latest stable Stripe API version, eliminating version mismatch errors immediately.

- Secure Webhook Setup: It configures the webhook endpoint in the Stripe Dashboard, provisions the necessary server route, and implements the mandatory signature verification logic—a step developers often miscode. This automation reduces technical configuration errors to near zero.

- Environment Key Rotation: Imagine.bo manages best practices for API key storage and rotation, significantly enhancing security and preventing key-related deployment failures and ensuring zero-downtime.

- Guaranteed Scalability & Performance for High Load: Technical failures often spike during periods of high user traffic when a traditional server infrastructure buckles. Imagine.bo addresses the “Server Communication Failures” headache head-on.

- 1,000 Transactions Per Second (TPS) Guarantee: Your applications are built on hyper-scalable cloud architectures (AWS/GCP). This means the server can absorb massive traffic spikes without slowing down, ensuring the payment flow completes well within the timeout window, effectively eliminating load-related payment failures. Your infrastructure scales seamlessly with user demand, even for complex applications.

- Expert Developer Assistance as the Ultimate Safety Net: While AI automation is powerful, true reliability requires human oversight for edge cases. Imagine.bo provides the ultimate hybrid solution.

- Human Intervention for Complex Logic: If your payment setup involves highly specialized, multi-tiered recurring billing models, legacy system data migration, or complex tax compliance unique to your business, the AI can defer to a professional developer, showcasing the evolution of developer roles. You can simply assign the specific task to a real developer through the platform, ensuring rapid, accurate resolution for any problem beyond standard automation, minimizing downtime and technical debt.

3. Systematic Troubleshooting Workflow in Detail

A structured approach to diagnostics minimizes time spent debugging and focuses efforts where they matter most.

Step 1: Identify and Analyze the Error Code in the Stripe Dashboard

Your primary diagnostic tool is the Stripe Dashboard’s Developers/Logs section.

- Filtering: Use the log filters to search by transaction ID, customer ID, or API key used. Look at the full request and response headers.

- Timestamp Cross-Reference: Compare the timestamp in the Stripe log with the timestamp in your application’s server logs. A mismatch can indicate network latency or an issue with your server’s internal clock.

- Decipher the Code: Stripe’s error codes are highly informative (e.g.,

authentication_error,processing_error). These codes instantly tell you if the problem is authorization-related or infrastructure-related, guiding your subsequent steps.

Step 2: Communicate and Resolve Customer-Facing Solutions

When the log points to a card or bank issue, the focus shifts to secure, clear communication.

- Present Error Securely: Never display the raw Stripe error code to the customer. Instead, translate it into plain language (e.g., “The bank declined this transaction. Please try a different card or contact your bank for authorization.”).

- Facilitate Card Updates: Provide a prominent, user-friendly link or portal that allows the customer to securely enter new payment details. This process must use Stripe Elements for tokenization—never handle raw card data yourself.

Step 3: Deep Developer Checklist (API and Webhook Configuration)

For technical errors that bypass the AI configuration layer (or for manual checks):

- Test API Keys: Double-check your environment variables. A common mistake is using the

sk_test_key in your live environment, leading to failed transactions that appear successful in your test logs. - Webhook Signature Verification: Ensure the signature generated by your server using your webhook secret matches the one sent in the

Stripe-Signatureheader. If using a service like Imagine.bo, verify that the managed infrastructure has correctly deployed the secret environment variable. - Local Testing with Stripe CLI: Use the Stripe Command Line Interface (CLI) to simulate webhook events locally. This allows you to test your server’s handler logic without deploying code, catching potential processing errors before they hit production.

4. Advanced Prevention, Security, and Long-Term Health

Moving beyond reactive troubleshooting requires proactive security and logging strategies.

- Enhance Security with 3D Secure and AVS:

- 3D Secure (3DS): For high-value or high-risk transactions, implement 3D Secure. This adds an authentication layer managed by the card issuer, transferring liability for fraudulent chargebacks from your business to the bank.

- AVS Checks: Ensure you always pass the billing address fields in your API calls to utilize AVS checks, which help verify the cardholder’s identity and reduce fraud-related declines.

- Robust Logging and Monitoring: Log every API request and response, including the

request_id. This unique ID allows you to instantly find the exact transaction record in the Stripe Dashboard logs, drastically speeding up debugging. Integrate third-party monitoring tools (like Datadog or Sentry) to watch for sudden spikes incard_declinedor4xxAPI errors, signaling a potential systemic issue. - Regular Software and Platform Updates: Staying current is non-negotiable. Whether you are using a framework or a no-code builder, ensure everything is on the latest version. For Imagine.bo users, the platform handles core system updates automatically, but check for any new component or feature integrations you may have added manually.

Conclusion

Stripe is an incredibly powerful engine for your business, but like any powerful tool, it demands respect for its complexity. By developing a systematic troubleshooting methodology—starting with the Stripe log, moving to customer communication, and finally checking integration points—you can resolve 95% of payment issues quickly. More importantly, by leveraging AI-driven, highly reliable platforms like Imagine.bo, you can proactively eliminate the most common technical pain points associated with configuration, security, and performance. This combination of smart automation and developer-grade support ensures maximum payment success rates, allowing you to focus purely on business growth, knowing your transaction infrastructure is handled with professional-grade precision.

Launch Your App Today

Ready to launch? Skip the tech stress. Describe, Build, Launch in three simple steps.

Build